Instructions For Form C-8000h - Michigan Sbt Apportionment Formula

ADVERTISEMENT

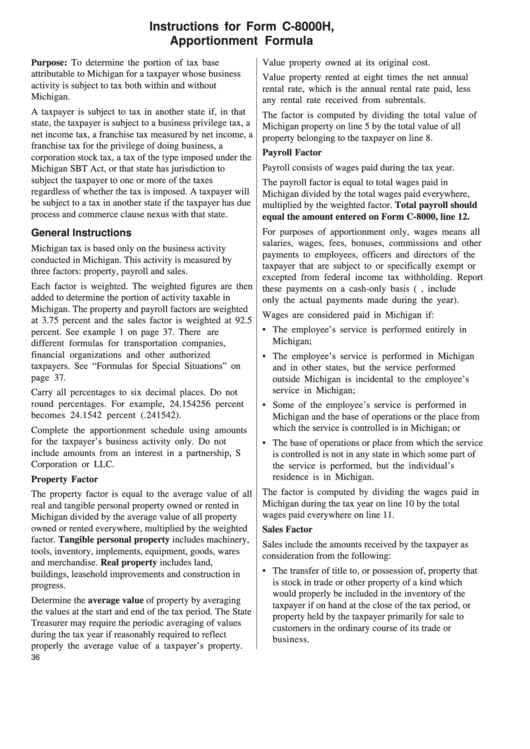

Instructions for Form C-8000H,

Apportionment Formula

P urpose: To determine the portion of tax base

Value property owned at its original cost.

attributable to Michigan for a taxpayer whose business

Value property rented at eight times the net annual

activity is subject to tax both within and without

rental rate, which is the annual rental rate paid, less

Michigan.

any rental rate received from subrentals.

A taxpayer is subject to tax in another state if, in that

The factor is computed by dividing the total value of

state, the taxpayer is subject to a business privilege tax, a

Michigan property on line 5 by the total value of all

net income tax, a franchise tax measured by net income, a

property belonging to the taxpayer on line 8.

franchise tax for the privilege of doing business, a

Payroll Factor

corporation stock tax, a tax of the type imposed under the

Payroll consists of wages paid during the tax year.

Michigan SBT Act, or that state has jurisdiction to

subject the taxpayer to one or more of the taxes

The payroll factor is equal to total wages paid in

regardless of whether the tax is imposed. A taxpayer will

Michigan divided by the total wages paid everywhere,

be subject to a tax in another state if the taxpayer has due

multiplied by the weighted factor. Total payroll should

process and commerce clause nexus with that state.

equal the amount entered on Form C-8000, line 12.

For purposes of apportionment only, wages means all

General Instructions

salaries, wages, fees, bonuses, commissions and other

Michigan tax is based only on the business activity

payments to employees, officers and directors of the

conducted in Michigan. This activity is measured by

taxpayer that are subject to or specifically exempt or

three factors: property, payroll and sales.

excepted from federal income tax withholding. Report

Each factor is weighted. The weighted figures are then

these payments on a cash-only basis (i.e., include

added to determine the portion of activity taxable in

only the actual payments made during the year).

Michigan. The property and payroll factors are weighted

Wages are considered paid in Michigan if:

at 3.75 percent and the sales factor is weighted at 92.5

• The employee’s service is performed entirely in

percent. See example 1 on page 37. There are

Michigan;

different formulas for transportation companies,

financial organizations and other authorized

• The employee’s service is performed in Michigan

taxpayers. See “Formulas for Special Situations” on

and in other states, but the service performed

page 37.

outside Michigan is incidental to the employee’s

service in Michigan;

Carry all percentages to six decimal places. Do not

round percentages. For example, 24.154256 percent

• Some of the employee’s service is performed in

becomes 24.1542 percent (.241542).

Michigan and the base of operations or the place from

which the service is controlled is in Michigan; or

Complete the apportionment schedule using amounts

for the taxpayer’s business activity only. Do not

• The base of operations or place from which the service

include amounts from an interest in a partnership, S

is controlled is not in any state in which some part of

Corporation or LLC.

the service is performed, but the individual’s

residence is in Michigan.

Property Factor

The factor is computed by dividing the wages paid in

The property factor is equal to the average value of all

Michigan during the tax year on line 10 by the total

real and tangible personal property owned or rented in

wages paid everywhere on line 11.

Michigan divided by the average value of all property

owned or rented everywhere, multiplied by the weighted

Sales Factor

factor. Tangible personal property includes machinery,

Sales include the amounts received by the taxpayer as

tools, inventory, implements, equipment, goods, wares

consideration from the following:

and merchandise. Real property includes land,

• The transfer of title to, or possession of, property that

buildings, leasehold improvements and construction in

is stock in trade or other property of a kind which

progress.

would properly be included in the inventory of the

Determine the average value of property by averaging

taxpayer if on hand at the close of the tax period, or

the values at the start and end of the tax period. The State

property held by the taxpayer primarily for sale to

Treasurer may require the periodic averaging of values

customers in the ordinary course of its trade or

during the tax year if reasonably required to reflect

business.

properly the average value of a taxpayer’s property.

36

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3