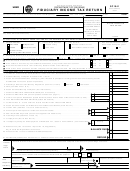

North Dakota Office of State Tax Commissioner

Final

Amended

North Dakota

Schedule K-1

2007

Calendar year 2007

(Jan. 1 - Dec. 31, 2007)

Estate's or

trust's tax

(Form 38)

Fiscal year:

Beginning _______________, 2007

year:

Beneficiary's Share of North Dakota Income (Loss),

Ending _______________, 20 ____

Deductions, Adjustments, Credits, and Other Items

Part 3 continued . . .

See separate instructions

10 Renaissance zone: Historic property

preservation/renovation tax credit

Part 1

Estate or trust information

11 Renaissance zone: Renaissance fund

A Estate's or trust's federal EIN

organization investment tax credit

12 Seed capital investment tax credit

B Name of estate or trust

13 Agricultural commodity processing

facility investment tax credit

C Fiduciary's name, address, city, state, and ZIP code

14 Supplier biodiesel fuel tax credit

15 Seller biodiesel fuel tax credit

16 Biomass, geothermal, solar, or wind

energy device tax credit

17 Certified North Dakota nonprofit development

corporation investment tax credit

Beneficiary information

Part 2

18 Employer internship program tax credit

D Beneficiary's SSN or FEIN (from Federal Schedule K-1)

19 Microbusiness tax credit

E Beneficiary's name, address, city, state, and ZIP code

20 Research expense tax credit

(from Federal Schedule K-1)

21 Angel fund investment tax credit

22 Endowment fund tax credit

Part 4

Nonresident individual, estate or trust

beneficiary only - North Dakota income (loss)

F What type of entity is this beneficiary? ____________________________

23 Interest income

G If beneficiary is an individual, estate, or trust, beneficiary is a:

Full-year resident

of North Dakota

Part-year resident

24 Ordinary dividends

of North Dakota

Full-year nonresident of North Dakota

25 Net short-term capital gain

H If beneficiary is a full-year nonresident

26 Net long-term capital gain

Yes

No

individual, is beneficiary included in a

composite return?

27 Other portfolio and nonbusiness income

Part 3

All beneficiaries - North Dakota

28 Ordinary business income

adjustments and tax credits

29 Net rental real estate income

1 Federally-exempt income from non-ND state

i

and local bonds and foreign securities

30 Other rental income

2 State and local income taxes deducted in

calculating ordinary income (loss)

31 Directly apportioned deductions

3 Interest from U.S. obligations

32 Final year deductions

4 Renaissance zone income exemption

33 Other

5 New or expanding business exemption

6 a Beginning farmer gain deduction

Part 5

Nonresident individual beneficiary only

b Beginning farmer interest deduction

34 North Dakota distributive share of

income (loss)

c Beginning farmer rent deduction

35 North Dakota income tax withheld

7 Beginning entrepreneur rent deduction

8 Gain from eminent domain sale

36 North Dakota composite income tax

9 College SAVE contribution deduction

1

1 2

2 3

3 4

4 5

5