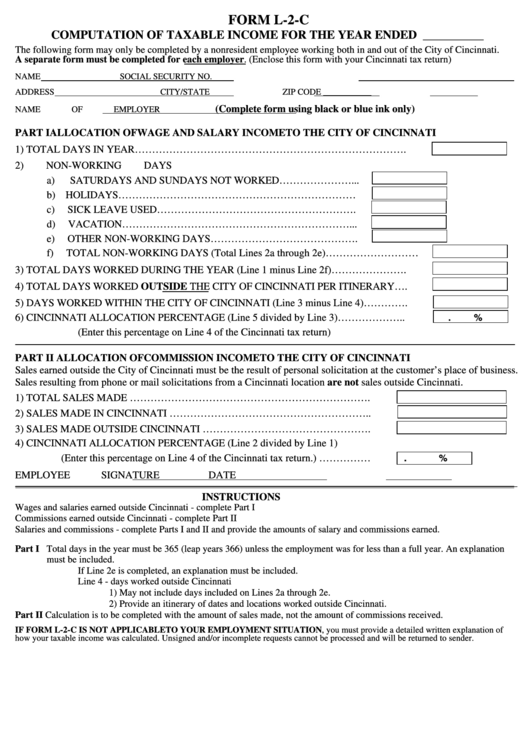

FORM L-2-C

COMPUTATION OF TAXABLE INCOME FOR THE YEAR ENDED __________

The following form may only be completed by a nonresident employee working both in and out of the City of Cincinnati.

A separate form must be completed for each employer. (Enclose this form with your Cincinnati tax return)

NAME

SOCIAL SECURITY NO.

ADDRESS

CITY/STATE

ZIP CODE ___________

(Complete form using black or blue ink only)

NAME OF EMPLOYER

PART I

ALLOCATION OF WAGE AND SALARY INCOME TO THE CITY OF CINCINNATI

1)

TOTAL DAYS IN YEAR…………………………………………………………………….

2)

NON-WORKING DAYS

a)

SATURDAYS AND SUNDAYS NOT WORKED…………………...

b)

HOLIDAYS……………………………………………………………

c)

SICK LEAVE USED………………………………………………….

d)

VACATION…………………………………………………………...

e)

OTHER NON-WORKING DAYS…………………………………….

f)

TOTAL NON-WORKING DAYS (Total Lines 2a through 2e)………………………

3)

TOTAL DAYS WORKED DURING THE YEAR (Line 1 minus Line 2f)………………….

4)

TOTAL DAYS WORKED OUTSIDE THE CITY OF CINCINNATI PER ITINERARY….

5)

DAYS WORKED WITHIN THE CITY OF CINCINNATI (Line 3 minus Line 4)………….

6)

CINCINNATI ALLOCATION PERCENTAGE (Line 5 divided by Line 3)………………..

.

%

(Enter this percentage on Line 4 of the Cincinnati tax return)

PART II

ALLOCATION OF COMMISSION INCOME TO THE CITY OF CINCINNATI

Sales earned outside the City of Cincinnati must be the result of personal solicitation at the customer’s place of business.

Sales resulting from phone or mail solicitations from a Cincinnati location are not sales outside Cincinnati.

1)

TOTAL SALES MADE …………………………………………………………….

2)

SALES MADE IN CINCINNATI …………………………………………………..

3)

SALES MADE OUTSIDE CINCINNATI ………………………………………….

4)

CINCINNATI ALLOCATION PERCENTAGE (Line 2 divided by Line 1)

(Enter this percentage on Line 4 of the Cincinnati tax return.) ……………

.

%

EMPLOYEE SIGNATURE

DATE

________________________________________________________________________________________________

INSTRUCTIONS

Wages and salaries earned outside Cincinnati - complete Part I

Commissions earned outside Cincinnati - complete Part II

Salaries and commissions - complete Parts I and II and provide the amounts of salary and commissions earned.

Part I Total days in the year must be 365 (leap years 366) unless the employment was for less than a full year. An explanation

must be included.

If Line 2e is completed, an explanation must be included.

Line 4 - days worked outside Cincinnati

1) May not include days included on Lines 2a through 2e.

2) Provide an itinerary of dates and locations worked outside Cincinnati.

Part II Calculation is to be completed with the amount of sales made, not the amount of commissions received.

IF FORM L-2-C IS NOT APPLICABLE TO YOUR EMPLOYMENT SITUATION, you must provide a detailed written explanation of

how your taxable income was calculated. Unsigned and/or incomplete requests cannot be processed and will be returned to sender.

1

1