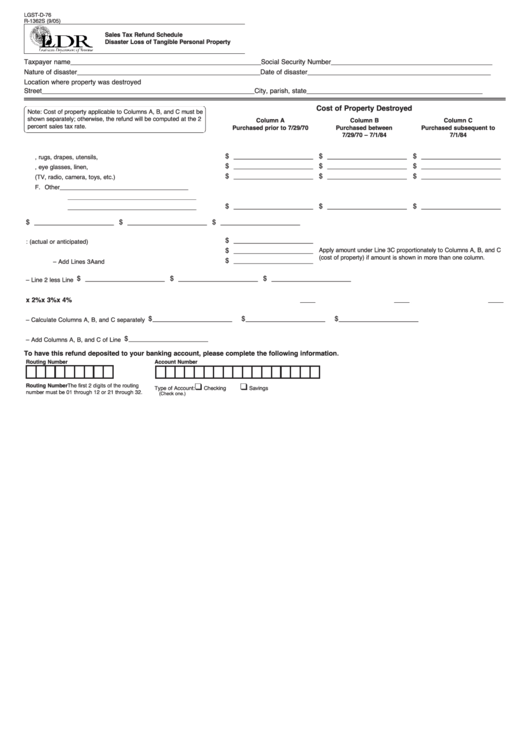

LGST-D-76

R-1362S (9/05)

Sales Tax Refund Schedule

Disaster Loss of Tangible Personal Property

Taxpayer name ____________________________________________________ Social Security Number ____________________________________________

Nature of disaster __________________________________________________ Date of disaster __________________________________________________

Location where property was destroyed

Street

__________________________________________________________ City, parish, state ________________________________________________

Cost of Property Destroyed

Note: Cost of property applicable to Columns A, B, and C must be

shown separately; otherwise, the refund will be computed at the 2

Column A

Column B

Column C

percent sales tax rate.

Purchased prior to 7/29/70

Purchased between

Purchased subsequent to

7/29/70 – 7/1/84

7/1/84

1. Personal Property

__________________

__________________

__________________

$

$

$

A. Furniture, rugs, drapes, utensils, etc. ..............................................

__________________

__________________

__________________

$

$

$

B. Clothing, eye glasses, linen, etc.......................................................

__________________

__________________

__________________

$

$

$

C. Recreation equipment (TV, radio, camera, toys, etc.) ......................

F. Other

______________________________________

______________________________________

__________________

__________________

__________________

$

$

$

______________________________________ ..............

__________________

__________________

__________________

$

$

$

2. Total - Lines 1A through 1F....................................................................

__________________

$

3. Less: A. Insurance proceeds (actual or anticipated) ..........................

__________________

$

Apply amount under Line 3C proportionately to Columns A, B, and C

B. Proceeds from employer or disaster relief agencies ............

(cost of property) if amount is shown in more than one column.

__________________

$

C. Total – Add Lines 3A and 3B ................................................

__________________

__________________

__________________

$

$

$

4. Disaster loss – Line 2 less Line 3C ......................................................

x 2%

x 3%

x 4%

5. Sales tax rate applicable........................................................................

__________________

__________________

__________________

$

$

$

6. Refund due – Calculate Columns A, B, and C separately ....................

__________________

$

7. Total refund due – Add Columns A, B, and C of Line 6 ........................

.

To have this refund deposited to your banking account, please complete the following information

Routing Number

Account Number

❑

❑

Routing Number The first 2 digits of the routing

Type of Account:

Checking

Savings

number must be 01 through 12 or 21 through 32.

(Check one.)

1

1