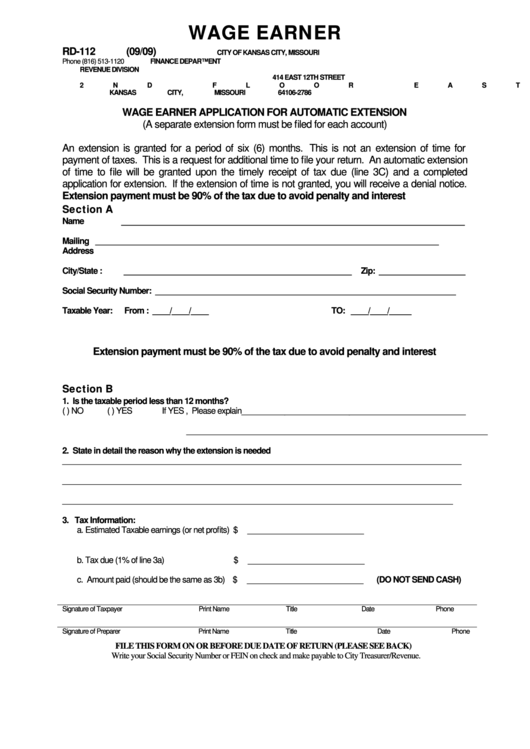

Form Rd-112 - Wage Earner Application For Automatic Extension - Kansas, Missouri

ADVERTISEMENT

WAGE EARNER

RD-112 (09/09)

CITY OF KANSAS CITY, MISSOURI

Phone (816) 513-1120

FINANCE DEPARTMENT

REVENUE DIVISION

414 EAST 12TH STREET

2ND FLOOR EAST

KANSAS CITY, MISSOURI 64106-2786

WAGE EARNER APPLICATION FOR AUTOMATIC EXTENSION

(A separate extension form must be filed for each account)

An extension is granted for a period of six (6) months. This is not an extension of time for

payment of taxes. This is a request for additional time to file your return. An automatic extension

of time to file will be granted upon the timely receipt of tax due (line 3C) and a completed

application for extension. If the extension of time is not granted, you will receive a denial notice.

Extension payment must be 90% of the tax due to avoid penalty and interest

Section A

Name

________________________________________________________________________________

Mailing

________________________________________________________________________________

Address

City/State :

_____________________________________________________

Zip: ____________________

Social Security Number: ______________________________________________________________________

Taxable Year:

From : ____/____/____

TO: ____/____/_____

Extension payment must be 90% of the tax due to avoid penalty and interest

Section B

1. Is the taxable period less than 12 months?

( ) NO

( ) YES

If YES , Please explain____________________________________________________

______________________________________________________________________

2. State in detail the reason why the extension is needed

_____________________________________________________________________________________________

_____________________________________________________________________________________________

___________________________________________________________________________________________

3. Tax Information:

a. Estimated Taxable earnings (or net profits) $

___________________________

b. Tax due (1% of line 3a)

$

___________________________

c. Amount paid (should be the same as 3b) $

___________________________

(DO NOT SEND CASH)

Signature of Taxpayer

Print Name

Title

Date

Phone

Signature of Preparer

Print Name

Title

Date

Phone

FILE THIS FORM ON OR BEFORE DUE DATE OF RETURN (PLEASE SEE BACK)

Write your Social Security Number or FEIN on check and make payable to City Treasurer/Revenue.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1