Reset Form

Print and Reset Form

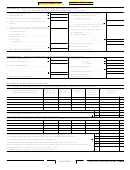

Schedule A Taxes Deducted. Use additional sheet(s) if necessary.

(b)

(c)

(d)

(a)

Taxing authority

Total amount

Nondeductible amount

Nature of tax

Total. Enter total of column (c) on Schedule F, line 17, and total of column (d) on Side 1, line 2 or line 3

Schedule F Computation of Net Income. See instructions.

1 a) Gross receipts or gross sales__________________________________________

¼ ¼ ¼ ¼ ¼

b) Less returns and allowance____________________________________________c) Balance . . .

1c

¼ ¼ ¼ ¼ ¼

2 Cost of goods sold. Attach federal Schedule A (California Schedule V) . . . . . . . . . . . . . . . . . . . . . . . . .

2

¼ ¼ ¼ ¼ ¼

3 Gross profit. Subtract line 2 from line 1c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

¼ ¼ ¼ ¼ ¼

4 Total dividends. Attach federal Schedule C, California Schedule H (100) . . . . . . . . . . . . . . . . . . . . . . . .

4

¼ ¼ ¼ ¼ ¼

5 a) Interest on obligations of the United States and U.S. instrumentalities . . . . . . . . . . . . . . . . . . . . . .

5a

¼ ¼ ¼ ¼ ¼

b) Other interest. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5b

¼ ¼ ¼ ¼ ¼

6 Gross rents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

¼ ¼ ¼ ¼ ¼

7 Gross royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

¼ ¼ ¼ ¼ ¼

8 Capital gain net income. Attach federal Schedule D (California Schedule D) . . . . . . . . . . . . . . . . . . . . .

8

¼ ¼ ¼ ¼ ¼

9 Ordinary gain (loss). Attach federal Form 4797 (California Schedule D-1) . . . . . . . . . . . . . . . . . . . . . .

9

¼ ¼ ¼ ¼ ¼

10 Other income (loss). Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

¼ ¼ ¼ ¼ ¼

11 Total income. Add line 3 through line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

12 Compensation of officers. Attach federal Schedule E or

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

¼ ¼ ¼ ¼ ¼

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

equivalent schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

¼ ¼ ¼ ¼ ¼

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

13 Salaries and wages (not deducted elsewhere) . . . . . . . . . . . . . .

13

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

14 Repairs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

¼ ¼ ¼ ¼ ¼

15 Bad debts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

¼ ¼ ¼ ¼ ¼

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

16 Rents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

¼ ¼ ¼ ¼ ¼

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

17 Taxes (California Schedule A) . . . . . . . . . . . . . . . . . . . . . . . . . .

17

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

¼ ¼ ¼ ¼ ¼

18 Interest. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

¼ ¼ ¼ ¼ ¼

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

19 Contributions. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . .

19

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

20 Depreciation. Attach federal

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

Form 4562 and FTB 3885 . . . . .

20

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

21 Less depreciation claimed

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

¼ ¼ ¼ ¼ ¼

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

elsewhere on return . . . . . . . . .

21a

21b

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

¼ ¼ ¼ ¼ ¼

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

22 Depletion. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

23 Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

24 Pension, profit-sharing plans, etc. . . . . . . . . . . . . . . . . . . . . . . .

24

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

25 Employee benefit plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

26 a) Total travel and entertainment_________________________

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

¼ ¼ ¼ ¼ ¼

b) Deductible amounts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26b

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

¼ ¼ ¼ ¼ ¼

27 Other deductions. Attach schedule . . . . . . . . . . . . . . . . . . . . . .

27

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

28 Specific deduction for 23701r or 23701t organizations.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

¼ ¼ ¼ ¼ ¼

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

¼ ¼ ¼ ¼ ¼

29 Total deductions. Add line 12 through line 28 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29

¼ ¼ ¼ ¼ ¼

30 Net income before state adjustments. Subtract line 29 from line 11. Enter here and on Side 1, line 1 .

30

Schedule J Add-On Taxes and Recapture of Tax Credits. See instructions.

¼ ¼ ¼ ¼ ¼

1 LIFO recapture due to S corporation election, IRC Sec. 1363(d) deferral: $____________________ . . . . .

1

¼ ¼ ¼ ¼ ¼

2 Interest computed under the look-back method for completed long-term contracts (Attach form FTB 3834)

2

¼ ¼ ¼ ¼ ¼

3 Interest on tax attributable to installment: a Sales of certain timeshares and residential lots . . . . . . . . . . .

3a

¼ ¼ ¼ ¼ ¼

b Method for nondealer installment obligations . . . . . . . . . . . . .

3b

¼ ¼ ¼ ¼ ¼

4 IRC Section 197(f)(9)(B)(ii) election . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

¼ ¼ ¼ ¼ ¼

5 Credit recapture name:______________________________________________________________ . . .

5

6 Combine line 1 through line 5, revise Side 2, line 37 or line 38, whichever applies, by this amount. Write

¼ ¼ ¼ ¼ ¼

“Schedule J” to the left of line 37 or line 38 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

10005303

Form 100

2005 Side 3

C1

1

1 2

2 3

3 4

4 5

5