Charitable Organizations Exemption Application Form - City Of Sterling Page 4

ADVERTISEMENT

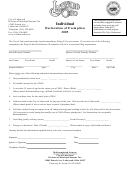

CITY OF STERLING

CHARITABLE ORGANIZATIONS EXEMPTION APPLICATION

INSTRUCTIONS

Line 1. Full name of organization. Enter the organization’s name exactly as it appears in its creating

document including amendments. Show the other name in parentheses, if the organization will be operating

under another name.

Line 2. Address of organization. Enter Sterling location and mailing address in parentheses, if the

organization uses a different mailing address.

Line 3. Type of organization. Enter the type of organization and attach a copy of the organizing document.

The organizing document must indicate how the organization was formed and a dissolution clause. What

will happen to the assets of the organization upon dissolution of the organization?

Line 4. Organizational purposes. Specify the organizational purposes of the organization. List all the

purposes of the organization.

Line 5. Employer identification number. Enter the nine-digit EIN the IRS assigned to the organization.

Line 6. Person to contact. Enter the name and telephone number of the person to contact during business

hours if more information is needed. The contact person should be an officer, director, or a person who is

familiar with the organization’s activities and is authorized to act on its behalf.

Line 7. Fiscal year end and date formed. Enter the month the organization’s annual accounting period

ends. Enter the date the organization started.

Line 8. It is important that you report all activities carried on by the organization to enable the City to make a

proper determination of the organization’s exempt status. Attach additional pages if necessary.

Line 9. If it is anticipated that the organization’s principal sources of support will increase or decrease

substantially in relation to the organization’s total support, attach a statement describing anticipated changes

and explaining the basis for the expectation.

Line 10. “Fundraising activity” includes the solicitation of contributions and both functionally related activities

and unrelated activities. Include a description of the nature and magnitude of the activities.

Line 11a. Furnish the mailing addresses of the organization’s principal officers, directors, or trustees. Do

not give the address of the organization.

Line 11b. The annual compensation includes salary, bonus, and any other form of payment to the individual

for services while employed by the organization.

Line 11c. Public officials include anyone holding an elected position or anyone appointed to a position by an

elected official.

Line 12. If your organization controls or is controlled by another exempt organization or a taxable

organization, answer “Yes”.

Line 13. If the organization conducts any financial transactions or nonfinancial activities with an exempt

organization or with a political organization, answer “Yes,” and explain.

Line 14. If the organization must report its income and expense activity to any other organization answer

“Yes”.

Line 15. Examples of assets used to perform an exempt function are: land, building, equipment, and

publications. Do not include cash or property producing investment income. If you have no assets used in

performing the organization’s exempt function, answer “N/A”.

Line 17. If another exempt organization, a taxable organization, or an individual manages the organization,

answer “Yes”.

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5