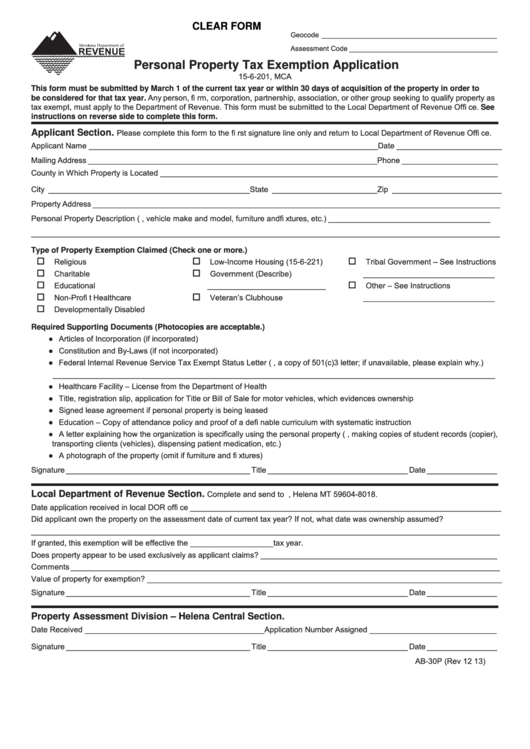

CLEAR FORM

Geocode _____________________________________________

Assessment Code ______________________________________

Personal Property Tax Exemption Application

15-6-201, MCA

This form must be submitted by March 1 of the current tax year or within 30 days of acquisition of the property in order to

be considered for that tax year. Any person, fi rm, corporation, partnership, association, or other group seeking to qualify property as

tax exempt, must apply to the Department of Revenue. This form must be submitted to the Local Department of Revenue Offi ce. See

instructions on reverse side to complete this form.

Please complete this form to the fi rst signature line only and return to Local Department of Revenue Offi ce.

Applicant Section.

Applicant Name __________________________________________________________________Date ________________________

Mailing Address __________________________________________________________________Phone ______________________

County in Which Property is Located _____________________________________________________________________________

City ______________________________________________ State ________________________Zip _________________________

Property Address _____________________________________________________________________________________________

Personal Property Description (i.e., vehicle make and model, furniture and fi xtures, etc.) _____________________________________

___________________________________________________________________________________________________________

Type of Property Exemption Claimed (Check one or more.)

Religious

Low-Income Housing (15-6-221)

Tribal Government – See Instructions

Charitable

Government (Describe)

______________________________

Educational

___________________________

Other – See Instructions

Non-Profi t Healthcare

Veteran’s Clubhouse

______________________________

Developmentally Disabled

Required Supporting Documents (Photocopies are acceptable.)

● Articles of Incorporation (if incorporated)

● Constitution and By-Laws (if not incorporated)

● Federal Internal Revenue Service Tax Exempt Status Letter (i.e., a copy of 501(c)3 letter; if unavailable, please explain why.)

_____________________________________________________________________________________________________

● Healthcare Facility – License from the Department of Health

● Title, registration slip, application for Title or Bill of Sale for motor vehicles, which evidences ownership

● Signed lease agreement if personal property is being leased

● Education – Copy of attendance policy and proof of a defi nable curriculum with systematic instruction

● A letter explaining how the organization is specifi cally using the personal property (i.e., making copies of student records (copier),

transporting clients (vehicles), dispensing patient medication, etc.)

● A photograph of the property (omit if furniture and fi xtures)

Signature __________________________________________ Title ________________________________ Date ________________

Local Department of Revenue Section.

Complete and send to P.O. Box 8018, Helena MT 59604-8018.

Date application received in local DOR offi ce _______________________________________________________________________

Did applicant own the property on the assessment date of current tax year? If not, what date was ownership assumed?

___________________________________________________________________________________________________________

If granted, this exemption will be effective the ___________________ tax year.

Does property appear to be used exclusively as applicant claims? ______________________________________________________

Comments __________________________________________________________________________________________________

Value of property for exemption? _________________________________________________________________________________

Signature __________________________________________ Title ________________________________ Date ________________

Property Assessment Division – Helena Central Section.

Date Received _________________________________________ Application Number Assigned _____________________________

Signature __________________________________________ Title ________________________________ Date ________________

AB-30P (Rev 12 13)

1

1