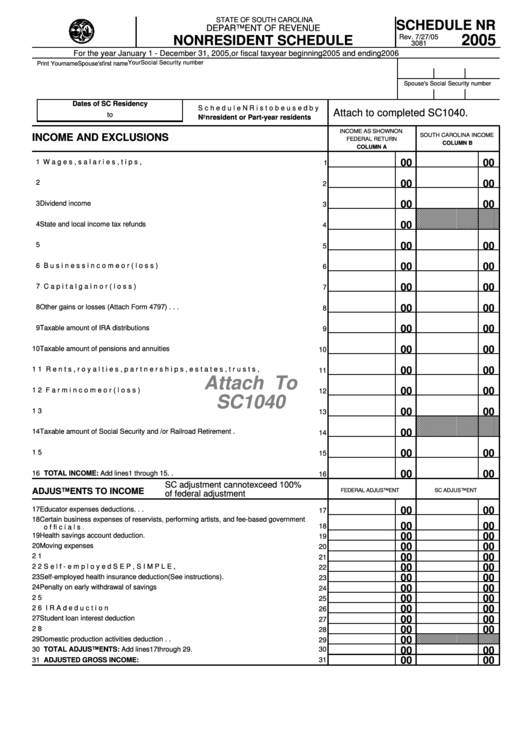

Schedule Nr - Attach To Sc1040 - Nonresident Schedule - 2005

ADVERTISEMENT

STATE OF SOUTH CAROLINA

SCHEDULE NR

DEPARTMENT OF REVENUE

2005

Rev. 7/27/05

NONRESIDENT SCHEDULE

3081

For the year January 1 - December 31, 2005, or fiscal tax year beginning

2005 and ending

2006

Your Social Security number

Print Your name

Spouse's first name

Spouse's Social Security number

Dates of SC Residency

Schedule NR is to be used by

Attach to completed SC1040.

to

Nonresident or Part-year residents

INCOME AS SHOWN ON

INCOME AND EXCLUSIONS

SOUTH CAROLINA INCOME

FEDERAL RETURN

COLUMN B

COLUMN A

00

00

1 Wages, salaries, tips, etc.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

00

00

2 Taxable interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

00

3 Dividend income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4 State and local income tax refunds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

00

5 Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Business income or (loss) . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

6

00

00

7 Capital gain or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

00

8 Other gains or losses (Attach Form 4797) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

00

9 Taxable amount of IRA distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

00

00

10 Taxable amount of pensions and annuities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11 Rents, royalties, partnerships, estates, trusts, etc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

11

Attach To

00

00

12 Farm income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

SC1040

00

00

13 Unemployment compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

00

14 Taxable amount of Social Security and /or Railroad Retirement . . . . . . . . . . . . . . . . . . . . .

14

00

00

15 Other income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

16 TOTAL INCOME: Add lines 1 through 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

16

SC adjustment cannot exceed 100%

ADJUSTMENTS TO INCOME

FEDERAL ADJUSTMENT

SC ADJUSTMENT

of federal adjustment

00

00

17 Educator expenses deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

18 Certain business expenses of reservists, performing artists, and fee-based government

00

00

18

officials. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

19 Health savings account deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

00

00

20 Moving expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

00

00

21 One-half of self employment tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

00

00

22 Self-employed SEP, SIMPLE, and qualified plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

00

00

23 Self-employed health insurance deduction (See instructions) . . . . . . . . . . . . . . . . . . . . . .

23

00

00

24 Penalty on early withdrawal of savings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

00

00

25 Alimony paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

00

00

26 IRA deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

00

00

27 Student loan interest deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

00

00

28 Tuition and fees deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

00

29 Domestic production activities deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29

00

00

30 TOTAL ADJUSTMENTS: Add lines 17 through 29 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30

00

00

31 ADJUSTED GROSS INCOME: Line 16 minus line 30. Enter here and on line 32 . . . . . . .

31

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2