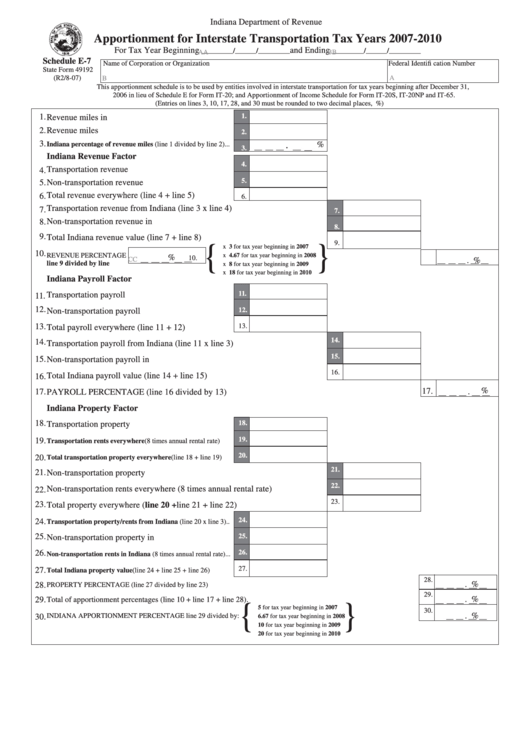

State Form 49192 - Schedule E-7 - Apportionment For Interstate Transportation Tax Years 2007-2010

ADVERTISEMENT

Indiana Department of Revenue

Apportionment for Interstate Transportation Tax Years 2007-2010

For Tax Year Beginning

and Ending

_________/______/_________

_________/______/_________

AA

BB

Schedule E-7

Name of Corporation or Organization

Federal Identifi cation Number

State Form 49192

(R2/8-07)

B

A

This apportionment schedule is to be used by entities involved in interstate transportation for tax years beginning after December 31,

2006 in lieu of Schedule E for Form IT-20; and Apportionment of Income Schedule for Form IT-20S, IT-20NP and IT-65.

(Entries on lines 3, 10, 17, 28, and 30 must be rounded to two decimal places, i.e. 98.76%)

1.

1.

Revenue miles in Indiana............................................

2.

Revenue miles everywhere..........................................

2.

3.

.

Indiana percentage of revenue miles (line 1 divided by line 2)...

%

3.

Indiana Revenue Factor

4.

Transportation revenue everywhere............................

4.

5.

5.

Non-transportation revenue everywhere.....................

Total revenue everywhere (line 4 + line 5)..................

6.

6.

Transportation revenue from Indiana (line 3 x line 4)............................................

7.

7.

Non-transportation revenue in Indiana...................................................................

8.

8.

9.

Total Indiana revenue value (line 7 + line 8)..........................................................

9.

{

}

x 3 for tax year beginning in 2007

10.

REVENUE PERCENTAGE

x 4.67 for tax year beginning in 2008

%

...................................................

10.

CC

.

%

line 9 divided by line 6......

x 8 for tax year beginning in 2009

x 18 for tax year beginning in 2010

Indiana Payroll Factor

11.

Transportation payroll everywhere..............................

11.

12.

12.

Non-transportation payroll everywhere.......................

13.

13.

Total payroll everywhere (line 11 + 12)......................

14.

14.

Transportation payroll from Indiana (line 11 x line 3)...........................................

15.

15.

Non-transportation payroll in Indiana....................................................................

16.

Total Indiana payroll value (line 14 + line 15).......................................................

16.

%

17.

17.

PAYROLL PERCENTAGE (line 16 divided by 13).........................................................................................

.

Indiana Property Factor

18.

18.

Transportation property everywhere............................

19.

19.

Transportation rents everywhere (8 times annual rental rate).....

20.

20.

Total transportation property everywhere (line 18 + line 19)....

21.

21.

Non-transportation property everywhere................................................................

22.

Non-transportation rents everywhere (8 times annual rental rate)..........................

22.

23.

23.

Total property everywhere (line 20 + line 21 + line 22)........................................

24.

24.

Transportation property/rents from Indiana (line 20 x line 3)..

25.

25.

Non-transportation property in Indiana.......................

26.

26.

Non-transportation rents in Indiana (8 times annual rental rate)...

27.

27.

Total Indiana property value (line 24 + line 25 + line 26)...........

28.

.

%

28.

PROPERTY PERCENTAGE (line 27 divided by line 23).......................................................................................................................

29.

.

%

29.

Total of apportionment percentages (line 10 + line 17 + line 28).

...........................................................................................................

{

}

5 for tax year beginning in 2007

30.

.

%

INDIANA APPORTIONMENT PERCENTAGE line 29 divided by:

...............................

30.

6.67 for tax year beginning in 2008

10 for tax year beginning in 2009

20 for tax year beginning in 2010

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1