Form Ct-31 - Cigarette And Unaffixed Stamp Inventory Report For Resident Distributors Page 2

ADVERTISEMENT

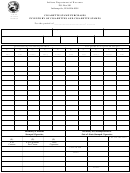

Part II. Unaffixed Connecticut Cigarette Tax Stamps or Decals

The total of Form CT-31, Part II, should agree with the amount reported on Line 4 of Form CT-15.

For the month of __________________________________ 20 ______

Quantity of Connecticut Cigarette

Face Value of Each

For DRS Use Only

Tax Stamps or Decals

Total

$

@ 3.00

$

@ 3.75

Total face value

$

Declaration: I declare under penalty of law that I have examined this return or document (including any accompanying schedules and statements)

and, to the best of my knowledge and belief, it is true, complete, and correct. I understand that the penalty for willfully delivering a false return

or document to the Department of Revenue Services (DRS) is a fine of not more than $5,000, or imprisonment for not more than five years,

or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Authorized signature

Date

Print name

Title

CT-31 Back (Rev. 09/09)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2