Falls Church City Monthly Meals Tax Report Template

ADVERTISEMENT

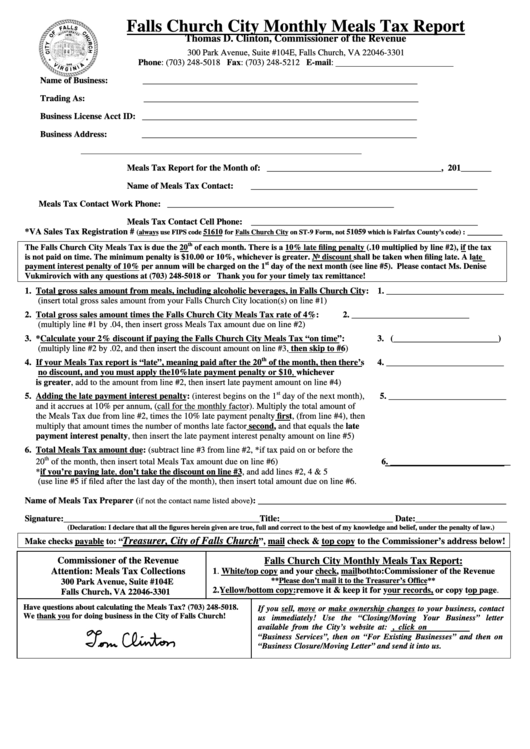

Falls Church City Monthly Meals Tax Report

Thomas D. Clinton, Commissioner of the Revenue

300 Park Avenue, Suite #104E, Falls Church, VA 22046-3301

Phone: (703) 248-5018 Fax: (703) 248-5212 E-mail: commissioner@fallschurchva.gov

Name of Business:

_______________________________________________________________

Trading As:

_______________________________________________________________

Business License Acct ID: _______________________________________________________________

Business Address:

_______________________________________________________________

_______________________________________________________________________________

Meals Tax Report for the Month of:

________________________________________, 201_______

Name of Meals Tax Contact:

____________________________________________________

Meals Tax Contact Work Phone:

____________________________________________________

Meals Tax Contact Cell Phone:

____________________________________________________

*VA Sales Tax Registration #

________

51610

51059

(always use FIPS code

for Falls Church City on ST-9 Form, not

which is Fairfax County’s code) :

th

The Falls Church City Meals Tax is due the 20

of each month. There is a 10% late filing penalty (.10 multiplied by line #2), if the tax

is not paid on time. The minimum penalty is $10.00 or 10%, whichever is greater. No discount shall be taken when filing late. A late

st

payment interest penalty of 10% per annum will be charged on the 1

day of the next month (see line #5). Please contact Ms. Denise

Vukmirovich with any questions at (703) 248-5018 or dvukmirovich@fallschurchva.gov. Thank you for your timely tax remittance!

1. Total gross sales amount from meals, including alcoholic beverages, in Falls Church City: 1. ___________________________

(insert total gross sales amount from your Falls Church City location(s) on line #1)

2. Total gross sales amount times the Falls Church City Meals Tax rate of 4%:

2. ___________________________

(multiply line #1 by .04, then insert gross Meals Tax amount due on line #2)

3. *Calculate your 2% discount if paying the Falls Church City Meals Tax “on time”:

3. (________________________)

(multiply line #2 by .02, and then insert the discount amount on line #3, then skip to #6)

th

4. If your Meals Tax report is “late”, meaning paid after the 20

of the month, then there’s

4. ___________________________

no discount, and you must apply the 10% late payment penalty or $10, whichever

is greater, add to the amount from line #2, then insert late payment amount on line #4)

st

5. Adding the late payment interest penalty: (interest begins on the 1

day of the next month),

5. ___________________________

and it accrues at 10% per annum, (call for the monthly factor). Multiply the total amount of

the Meals Tax due from line #2, times the 10% late payment penalty first, (from line #4), then

multiply that amount times the number of months late factor second, and that equals the late

payment interest penalty, then insert the late payment interest penalty amount on line #5)

6. Total Meals Tax amount due: (subtract line #3 from line #2, *if tax paid on or before the

th

_______________________

20

of the month, then insert total Meals Tax amount due on line #6)

6.

*if you’re paying late, don’t take the discount on line #3, and add lines #2, 4 & 5

(use line #5 if filed after the last day of the month), then insert total amount due on line #6.

Name of Meals Tax Preparer (

): _________________________________________________________

if not the contact name listed above

Signature:_____________________________________________Title:__________________________ Date:_____________________

(Declaration: I declare that all the figures herein given are true, full and correct to the best of my knowledge and belief, under the penalty of law.)

Treasurer, City of Falls Church

Make checks payable to: “

”, mail check & top copy to the Commissioner’s address below!

Commissioner of the Revenue

Falls Church City Monthly Meals Tax Report:

Attention: Meals Tax Collections

1. White/top copy and your check, mail both to: Commissioner of the Revenue

**Please don’t mail it to the Treasurer’s Office**

300 Park Avenue, Suite #104E

2. Yellow/bottom copy: remove it & keep it for your records, or copy top page.

Falls Church, VA 22046-3301

Have questions about calculating the Meals Tax? (703) 248-5018.

If you sell, move or make ownership changes to your business, contact

We thank you for doing business in the City of Falls Church!

us immediately! Use the “Closing/Moving Your Business” letter

available from the City’s website at: , click on

“Business Services”, then on “For Existing Businesses” and then on

“Business Closure/Moving Letter” and send it into us.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1