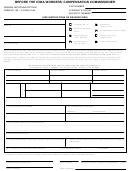

Form 77-100 - Registration For Substitute Forms Approval Form - Iowa Page 3

ADVERTISEMENT

CHAPTER 8

FORMS AND COMMUNICATIONS

[Prior to 12/17/86, Revenue Department[730]]

701-8.3(17A) Substitution of official forms. This rule is to provide guidance for the use of other than official

forms, whether they use paper, are computer-generated, or are created using other media for communication.

Approval shall be obtained prior to use of computer forms, replacement forms, reproduced forms, facsimile

forms, or any other forms not designed by the department. The director reserves the right to make changes to

forms when needed without prior notification to users of forms. The director also reserves the right to require

use of official forms in communications with the department concerning tax administration or other matters.

8.3(1) Types of substitute forms. Many types of forms may, upon approval, be substituted for official forms.

Descriptions of a partial list follow.

a. Reproduced forms. Reproduction (photocopy reprinting) of Iowa tax forms may be accomplished without

prior approval of the department provided the following conditions are met:

(1) There is no variation from the official copy or format provided by the department, including

reduction and enlargement or other format specification.

(2) Reprinting, copying, or reproduction of the form is not prohibited by another rule within this

chapter.

(3) Reprinting or reproduction of the form does not vary from criteria stated elsewhere in this chapter.

b. Replacement forms. Replacement forms are forms which are retypeset, produced by imagery, or

otherwise replicated using the department official form as a model. These forms may include facsimiles

of department forms that have been modified by the addition of pin-feeds, line enlargements, copy

deletion, or any other modifications. All replacement forms must be submitted to the department for

approval prior to use.

c. Computer-generated forms. Computer-generated forms are forms that are created in their entirety,

including layout, by the computer. These forms must be a facsimile of the official form that it is meant to

replace. Also, computer-generated forms must have prior approval of the department before the form

will be accepted for processing.

d. Federal forms. Federal forms, or their alternates, do not require prior approval for use provided the form

is approved for federal use and Iowa tax instructions or other administrative instructions authorize or

require the use of federal forms in lieu of official Iowa forms.

e. Magnetic tape, diskette, and electronic reporting. Any use of magnetic tape, diskettes, or any electronic

transmission in other than official form requires prior approval of the department.

8.3(2) Approval of substitute forms. Prior approval of substitute forms may be obtained by writing Technology

and Information Management Division, P.O. Box 10460, Des Moines, Iowa 50306, by telephoning (515)281-

7514, or by faxing (515)242-6040. Fax communication to the department of approval requests are acceptable

only in limited circumstances because approval of substitute paper document forms requires receipt by the

department of a sample of the actual substitute form before approval can be provided. Normally, approval will

be granted for use of substitute forms for one year only. If doubt exists about the need for approval of a

particular substitute form, the form should be submitted for consideration.

8.3(3) Failure to obtain required approval. Other than official or approved forms filed with the department may

be returned at the discretion of the director.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Life

1

1 2

2 3

3 4

4