Form Nys-100 - New York State Employer Registration For Unemployment Insurance, Withholding, And Wage Reporting - Department Of Taxation And Finance

ADVERTISEMENT

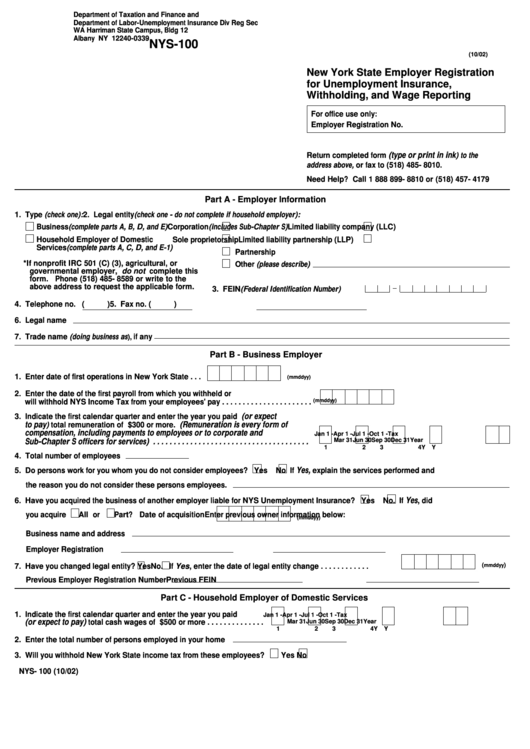

Department of Taxation and Finance and

Department of Labor-Unemployment Insurance Div Reg Sec

WA Harriman State Campus, Bldg 12

Albany NY 12240-0339

NYS-100

(10/02)

New York State Employer Registration

for Unemployment Insurance,

Withholding, and Wage Reporting

For office use only: U.I.

Employer Registration No.

(type or print in ink

Return completed form

) to the

address above, or fax to (518) 485-8010.

Need Help? Call 1 888 899-8810 or (518) 457-4179

Part A - Employer Information

1. Type (check one):

2. Legal entity (check one - do not complete if household employer):

Business (complete parts A, B, D, and E)

Corporation (includes Sub-Chapter S)

Limited liability company (LLC)

Household Employer of Domestic

Sole proprietorship

Limited liability partnership (LLP)

Services (complete parts A, C, D, and E-1)

Partnership

* If nonprofit IRC 501 (C) (3), agricultural, or

Other (please describe)

governmental employer, do not complete this

form. Phone (518) 485-8589 or write to the

above address to request the applicable form.

3. FEIN (Federal Identification Number)

4. Telephone no. (

)

5. Fax no.

(

)

6. Legal name

7. Trade name (doing business as

if any

),

Part B - Business Employer

1. Enter date of first operations in New York State . . .

(mmddyy)

2. Enter the date of the first payroll from which you withheld or

will withhold NYS Income Tax from your employees' pay . . . . . . . . . . . . . . . . . . . . . .

(mmddyy)

(or expect

3. Indicate the first calendar quarter and enter the year you paid

to pay

) total remuneration of $300 or more.

(Remuneration is every form of

compensation, including payments to employees or to corporate and

Jan 1 -

Apr 1 -

Jul 1 -

Oct 1 -

Tax

Sub-Chapter S officers for services) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Mar 31

Jun 30

Sep 30

Dec 31

Year

1

2

3

4

Y Y

4. Total number of employees

Yes,

5. Do persons work for you whom you do not consider employees?

Yes

No If

explain the services performed and

the reason you do not consider these persons employees.

Yes

6. Have you acquired the business of another employer liable for NYS Unemployment Insurance?

Yes

No. If

, did

All or

Part? Date of acquisition

you acquire

Enter previous owner information below:

(mmddyy)

Business name and address

Employer Registration No.

FEIN

7. Have you changed legal entity?

Yes

No. If Yes, enter the date of legal entity change . . . . . . . . . . . .

(

)

mmddyy

Previous Employer Registration Number

Previous FEIN

Part C - Household Employer of Domestic Services

1. Indicate the first calendar quarter and enter the year you paid

Jan 1 -

Apr 1 -

Jul 1 -

Oct 1 -

Tax

(or expect to pay)

total cash wages of $500 or more . . . . . . . . . . . . . .

Mar 31

Jun 30

Sep 30

Dec 31

Year

1

2

3

4

Y Y

2. Enter the total number of persons employed in your home

3. Will you withhold New York State income tax from these employees?

Yes

No

NYS-100 (10/02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4