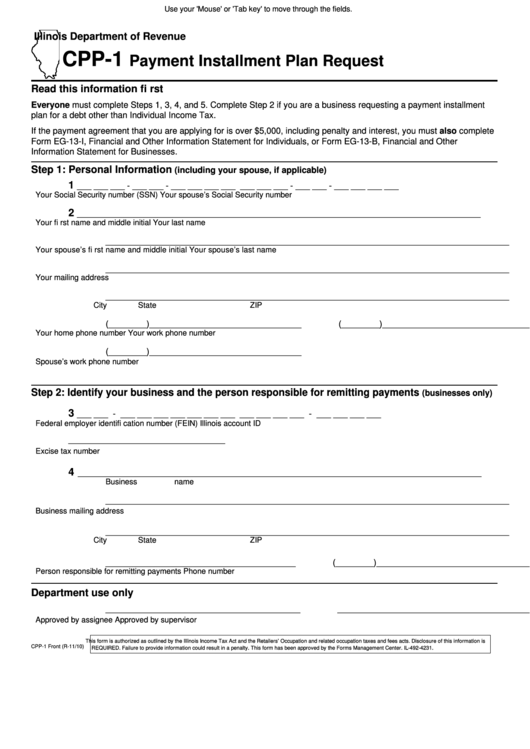

Use your 'Mouse' or 'Tab key' to move through the fields.

Illinois Department of Revenue

CPP-1

Payment Installment Plan Request

Read this information fi rst

Everyone must complete Steps 1, 3, 4, and 5. Complete Step 2 if you are a business requesting a payment installment

plan for a debt other than Individual Income Tax.

If the payment agreement that you are applying for is over $5,000, including penalty and interest, you must also complete

Form EG-13-I, Financial and Other Information Statement for Individuals, or Form EG-13-B, Financial and Other

Information Statement for Businesses.

Step 1: Personal Information

(including your spouse, if applicable)

1

___ ___ ___ - ___ ___ - ___ ___ ___ ___

___ ___ ___ - ___ ___ - ___ ___ ___ ___

Your Social Security number (SSN)

Your spouse’s Social Security number

2

_____________________________________________________________________________________

Your fi rst name and middle initial

Your last name

_____________________________________________________________________________________

Your spouse’s fi rst name and middle initial

Your spouse’s last name

_____________________________________________________________________________________

Your mailing address

_____________________________________________________________________________________

City

State

ZIP

(________)________________________________ (________)__________________________________

Your home phone number

Your work phone number

(________)________________________________

Spouse’s work phone number

Step 2: Identify your business and the person responsible for remitting payments

(businesses only)

3

___ ___ - ___ ___ ___ ___ ___ ___ ___

___ ___ ___ ___ - ___ ___ ___ ___

Federal employer identifi cation number (FEIN)

Illinois account ID

_________________________________

Excise tax number

4

_____________________________________________________________________________________

Business name

_____________________________________________________________________________________

Business mailing address

_____________________________________________________________________________________

City

State

ZIP

________________________________________

(________)__________________________________

Person responsible for remitting payments

Phone number

Department use only

_________________________________________ __________________________________________

Approved by assignee

Approved by supervisor

This form is authorized as outlined by the Illinois Income Tax Act and the Retailers’ Occupation and related occupation taxes and fees acts. Disclosure of this information is

CPP-1 Front (R-11/10)

REQUIRED. Failure to provide information could result in a penalty. This form has been approved by the Forms Management Center. IL-492-4231.

1

1 2

2