Form Ih-9 - Order Determining Inheritance Tax Due For Indiana Resident - 2005

ADVERTISEMENT

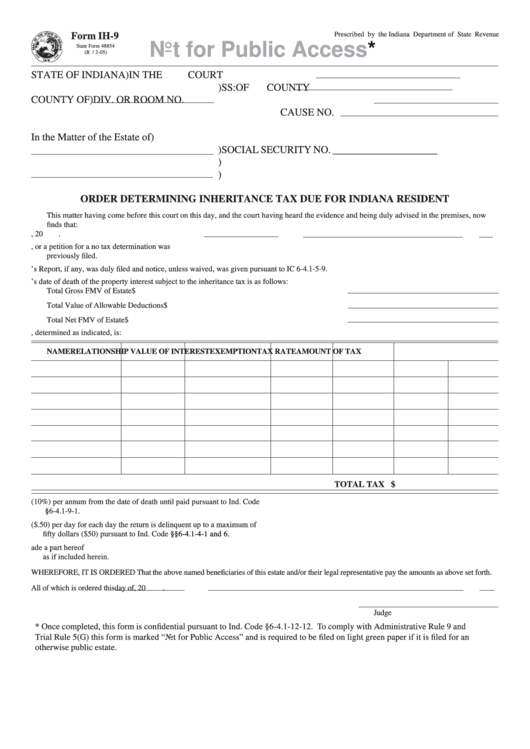

Prescribed by the Indiana Department of State Revenue

Form IH-9

Not for Public

Access*

State Form 48854

(R / 2-05)

STATE OF INDIANA

)

IN THE

COURT

)

SS:

OF

COUNTY

COUNTY OF

)

DIV. OR ROOM NO.

CAUSE NO.

In the Matter of the Estate of

)

)

SOCIAL SECURITY NO. ____________________

)

)

ORDER DETERMINING INHERITANCE TAX DUE FOR INDIANA RESIDENT

This matter having come before this court on this day, and the court having heard the evidence and being duly advised in the premises, now

finds that:

1.

The decedent died a resident of this county on the

day of

, 20

.

2.

The inheritance tax return was previously filed with this court and referred to the county assessor, or a petition for a no tax determination was

previously filed.

3.

The Appraiser’s Report, if any, was duly filed and notice, unless waived, was given pursuant to IC 6-4.1-5-9.

4.

The fair market value on the decedent’s date of death of the property interest subject to the inheritance tax is as follows:

Total Gross FMV of Estate

$

Total Value of Allowable Deductions

$

Total Net FMV of Estate

$

5.

The amount of inheritance tax due, determined as indicated, is:

NAME

RELATIONSHIP VALUE OF INTEREST

EXEMPTION

TAX RATE

AMOUNT OF TAX

TOTAL TAX $

6. The interest rate on any delinquent inheritance tax due is ten percent (10%) per annum from the date of death until paid pursuant to Ind. Code

§6-4.1-9-1.

7. The total penalty for late filing of the inheritance tax return is fifty cents ($.50) per day for each day the return is delinquent up to a maximum of

fifty dollars ($50) pursuant to Ind. Code

§§6-4.1-4-1 and 6.

8. The description of all Indiana real property owned by the decedent at the time of death is attached hereto as Exhibit A and made a part hereof

as if included herein.

WHEREFORE, IT IS ORDERED That the above named beneficiaries of this estate and/or their legal representative pay the amounts as above set forth.

All of which is ordered this

day of

, 20

.

Judge

* Once completed, this form is confidential pursuant to Ind. Code §6-4.1-12-12. To comply with Administrative Rule 9 and

Trial Rule 5(G) this form is marked “Not for Public Access” and is required to be filed on light green paper if it is filed for an

otherwise public estate.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1