2009 Federal Income Guidelines And Reduced Permit Fee Application Form

ADVERTISEMENT

2009 Federal Income Guidelines and Reduced

8800 Glacier Hwy, #109

P.O. Box 110302, Juneau, Alaska 99811-0302

Permit Fee Application

Ph (907) 789-6150 Fax (907) 789-6170

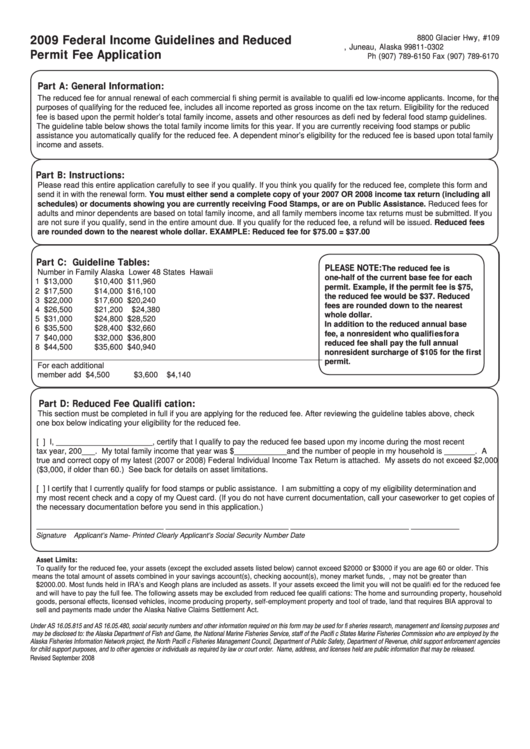

Part A: General Information:

The reduced fee for annual renewal of each commercial fi shing permit is available to qualifi ed low-income applicants. Income, for the

purposes of qualifying for the reduced fee, includes all income reported as gross income on the tax return. Eligibility for the reduced

fee is based upon the permit holder’s total family income, assets and other resources as defi ned by federal food stamp guidelines.

The guideline table below shows the total family income limits for this year. If you are currently receiving food stamps or public

assistance you automatically qualify for the reduced fee. A dependent minor’s eligibility for the reduced fee is based upon total family

income and assets.

Part B: Instructions:

Please read this entire application carefully to see if you qualify. If you think you qualify for the reduced fee, complete this form and

send it in with the renewal form. You must either send a complete copy of your 2007 OR 2008 income tax return (including all

schedules) or documents showing you are currently receiving Food Stamps, or are on Public Assistance. Reduced fees for

adults and minor dependents are based on total family income, and all family members income tax returns must be submitted. If you

are not sure if you qualify, send in the entire amount due. If you qualify for the reduced fee, a refund will be issued. Reduced fees

are rounded down to the nearest whole dollar. EXAMPLE: Reduced fee for $75.00 = $37.00

Part C: Guideline Tables:

PLEASE NOTE:

The reduced fee is

Number in Family

Alaska

Lower 48 States

Hawaii

one-half of the current base fee for each

1

$13,000

$10,400

$11,960

permit. Example, if the permit fee is $75,

2

$17,500

$14,000

$16,100

the reduced fee would be $37. Reduced

3

$22,000

$17,600

$20,240

fees are rounded down to the nearest

4

$26,500

$21,200

$24,380

whole dollar.

5

$31,000

$24,800

$28,520

In addition to the reduced annual base

6

$35,500

$28,400

$32,660

fee, a nonresident who qualifi es for a

7

$40,000

$32,000

$36,800

reduced fee shall pay the full annual

8

$44,500

$35,600

$40,940

nonresident surcharge of $105 for the fi rst

__________________________________________________________________

permit.

For each additional

member add

$4,500

$3,600

$4,140

Part D: Reduced Fee Qualifi cation:

This section must be completed in full if you are applying for the reduced fee. After reviewing the guideline tables above, check

one box below indicating your eligibility for the reduced fee.

[ ]

I, ______________________, certify that I qualify to pay the reduced fee based upon my income during the most recent

tax year, 200___. My total family income that year was $____________and the number of people in my household is _______. A

true and correct copy of my latest (2007 or 2008) Federal Individual Income Tax Return is attached. My assets do not exceed $2,000

($3,000, if older than 60.) See back for details on asset limitations.

[ ]

I certify that I currently qualify for food stamps or public assistance. I am submitting a copy of my eligibility determination and

my most recent check and a copy of my Quest card. (If you do not have current documentation, call your caseworker to get copies of

the necessary documentation before you send in this application.)

_____________________________

____________________________ ___________________________ ___________

Signature

Applicant’s Name- Printed Clearly

Applicant’s Social Security Number

Date

Asset Limits:

To qualify for the reduced fee, your assets (except the excluded assets listed below) cannot exceed $2000 or $3000 if you are age 60 or older. This

means the total amount of assets combined in your savings account(s), checking aocount(s), money market funds, etc..., may not be greater than

$2000.00. Most funds held in IRA’s and Keogh plans are included as assets. If your assets exceed the limit you will not be qualifi ed for the reduced fee

and will have to pay the full fee. The following assets may be excluded from reduced fee qualifi cations: The home and surrounding property, household

goods, personal effects, licensed vehicles, income producing property, self-employment property and tool of trade, land that requires BIA approval to

sell and payments made under the Alaska Native Claims Settlement Act.

Under AS 16.05.815 and AS 16.05.480, social security numbers and other information required on this form may be used for fi sheries research, management and licensing purposes and

may be disclosed to: the Alaska Department of Fish and Game, the National Marine Fisheries Service, staff of the Pacifi c States Marine Fisheries Commission who are employed by the

Alaska Fisheries Information Network project, the North Pacifi c Fisheries Management Council, Department of Public Safety, Department of Revenue, child support enforcement agencies

for child support purposes, and to other agencies or individuals as required by law or court order. Name, address, and licenses held are public information that may be released.

Revised September 2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1