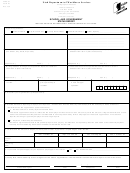

7a. Reason for applying:

New Business (proceed to Question 8)

We have an existing Unemployment account and are now requesting Workers’ Compensation coverage.

Provide your Unemployment account number

and proceed to Question 8.

Change of Entity - example: change from sole owner to corporation (continue with Question 7b)

Reorganization (continue with Question 7b)

Acquired/Purchased an existing business (continue with Question 7b, and complete page 5)

Merger (continue with Question 7b, and complete page 5)

We are an Employee Leasing company with clients in Wyoming

(attach a list of your Wyoming clients)

Other (describe): ___________________________________________________________________

7b. Information about the previous business:

Business Name:

Owner’s Name:

Federal Employer Identification Number

(FEIN):

Workers’ Compensation Employer #:

Unemployment Account #:

What percentage of the business did you acquire?

Did you own an interest in the previous business?

Date of acquisition:

8a

Date you first hired or expect to hire employees in Wyoming:

.

(excluding corporate officers and LLC members)

8b. Date you first paid wages to employees performing service in Wyoming:

(excluding corporate officers and LLC members)

8c. Will corporate officers/LLC members receive compensation or salary?

Yes

No

If yes, beginning on what date:

Will you be using an Employee Leasing or Professional Employer Organization?

Yes

No

If Yes, what is their business name and UI account number?

9. Estimated Total Monthly Payroll (Wyoming wages only):

$

10. Identify all owners, partners, corporate officers, trustees, or members:

Social Security

% of

State of

Date Residency

Name

Title

Number

ownership

Residency

Established

11. Federal Employer Identification Number (FEIN) as assigned by IRS:

(If you do not have an FEIN at this time, leave this space blank and submit your FEIN to the Division once you receive it.)

12. Are you covered by the Federal Unemployment Tax Act (FUTA)?

Yes

No

(Information on whether you are liable for FUTA can be obtained by contacting the IRS.)

3

1

1 2

2 3

3 4

4 5

5