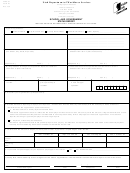

IF YOU ACQUIRED A BUSINESS

WYOMING WORKERS’ COMPENSATION

and UNEMPLOYMENT INSURANCE

TRANSFER OF EXPERIENCE RATE

When a person acquires the trade, organization, business, substantially all of the assets or

1

some or all the workforce

of an employer, that person shall assume the account(s), benefit

2

experience (UI) / claims experience (WC) and tax rate(s) of the relinquishing party.

NOTE:

A person who knowingly or with deliberate disregard of the facts or the

requirements of the Wyoming Employment Security Law or the Wyoming Workers’

Compensation Act, violates or attempts to violate or who knowingly advises another to

violate these Acts related to determining the assignment of a contribution rate shall be

subject to civil and felony penalties punishable by a fine of not more than $50,000,

imprisonment for not more than 5 years, or both.

3

Certification

The

undersigned

jointly

confirm

and

certify

to

the

Department

that

(“Acquiring Party”) acquired the trade,

organization, business, substantially all of the assets or some or all of the workforce of

(“Relinquishing Party”) and understand that the

Acquiring Party shall assume the account(s), benefits experience (UI) / claims experience

(WC) and tax rate(s) of the Relinquishing Party based upon said acquisition.

Acquisition Effective Date:

Acquiring Party’s Authorized Signature

Date

Relinquishing Party’s Authorized Signature

Date

1

The transfer of some or all of an employer’s workforce shall be considered a transfer of trade or business when, as

a result of the transfer, the transferring employer no longer performs trade or business with respect to the

transferred workforce, and the trade or business is performed by the person or entity to whom the workforce is

transferred.

2

If the relinquishing party remains in business or begins a new business, the relinquishing party shall be treated as a

new employer and assigned an account(s) and tax rate(s) as such. As a new employer, the relinquishing party must

submit a new, completed registration form.

3

The Department may determine a predecessor/successor relationship without Acquiring Party or Relinquishing

Party signatures, based on available information and application of the statutes.

6

1

1 2

2 3

3 4

4 5

5