Illinois Consent To Disclosure Form

ADVERTISEMENT

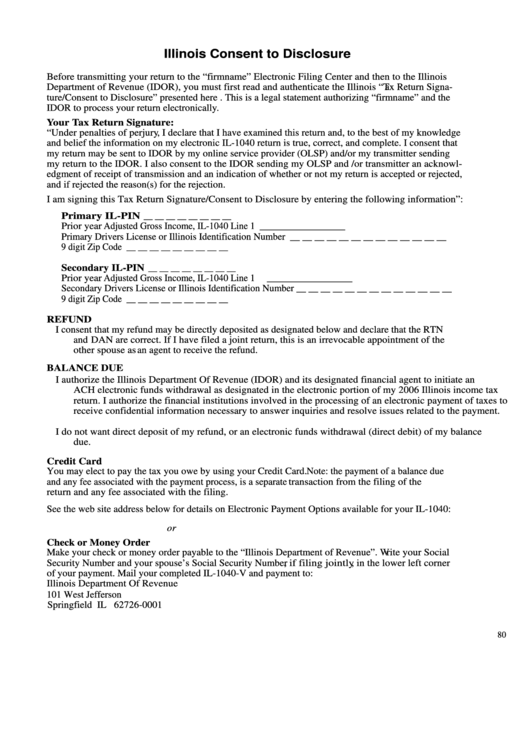

Illinois Consent to Disclosure

Before transmitting your return to the “firmname” Electronic Filing Center and then to the Illinois

Department of Revenue (IDOR), you must first read and authenticate the Illinois “Tax Return Signa-

ture/Consent to Disclosure” presented here . This is a legal statement authorizing “firmname” and the

IDOR to process your return electronically.

Your Tax Return Signature:

“Under penalties of perjury, I declare that I have examined this return and, to the best of my knowledge

and belief the information on my electronic IL-1040 return is true, correct, and complete. I consent that

my return may be sent to IDOR by my online service provider (OLSP) and/or my transmitter sending

my return to the IDOR. I also consent to the IDOR sending my OLSP and /or transmitter an acknowl-

edgment of receipt of transmission and an indication of whether or not my return is accepted or rejected,

and if rejected the reason(s) for the rejection.

I am signing this Tax Return Signature/Consent to Disclosure by entering the following information”:

Primary IL-PIN __ __ __ __ __ __ __ __

Prior year Adjusted Gross Income, IL-1040 Line 1 __________________

Primary Drivers License or Illinois Identification Number __ __ __ __ __ __ __ __ __ __ __ __ __

9 digit Zip Code __ __ __ __ __ __ __ __ __

Secondary IL-PIN __ __ __ __ __ __ __ __

Prior year Adjusted Gross Income, IL-1040 Line 1

__________________

Secondary Drivers License or Illinois Identification Number __ __ __ __ __ __ __ __ __ __ __ __ __

9 digit Zip Code __ __ __ __ __ __ __ __ __

REFUND

I consent that my refund may be directly deposited as designated below and declare that the RTN

and DAN are correct. If I have filed a joint return, this is an irrevocable appointment of the

other spouse as an agent to receive the refund.

BALANCE DUE

I authorize the Illinois Department Of Revenue (IDOR) and its designated financial agent to initiate an

ACH electronic funds withdrawal as designated in the electronic portion of my 2006 Illinois income tax

return. I authorize the financial institutions involved in the processing of an electronic payment of taxes to

receive confidential information necessary to answer inquiries and resolve issues related to the payment.

I do not want direct deposit of my refund, or an electronic funds withdrawal (direct debit) of my balance

due.

Credit Card

You may elect to pay the tax you owe by using your Credit Card. Note: the payment of a balance due

and any fee associated with the payment process, is a separate transaction from the filing of the

return and any fee associated with the filing.

See the web site address below for details on Electronic Payment Options available for your IL-1040:

or

Check or Money Order

Make your check or money order payable to the “Illinois Department of Revenue”. Write your Social

Security Number and your spouse’s Social Security Number, if filing jointly, in the lower left corner

of your payment. Mail your completed IL-1040-V and payment to:

Illinois Department Of Revenue

101 West Jefferson

Springfield IL 62726-0001

80

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1