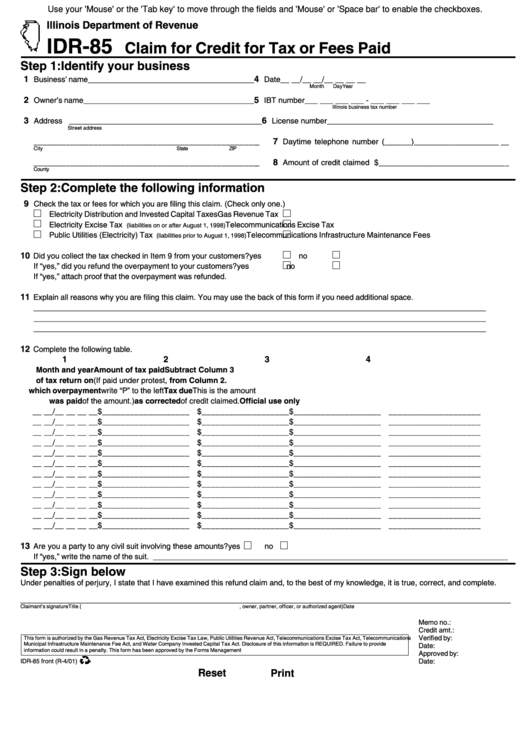

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

IDR-85

Claim for Credit for Tax or Fees Paid

Step 1: Identify your business

1

4

Business’ name ______________________________________

Date __ __/__ __/__ __ __ __

Month

Day

Year

2

5

Owner’s name _______________________________________

IBT number

___ ___ ___ ___ - ___ ___ ___ ___

Illinois business tax number

3

6

Address ____________________________________________

License number ______________________________________

Street address

7

__________________________________________________

Daytime telephone number (______)_____________________

City

State

ZIP

8

__________________________________________________

Amount of credit claimed $_____________________________

County

Step 2: Complete the following information

9

Check the tax or fees for which you are filing this claim. (Check only one.)

Electricity Distribution and Invested Capital Taxes

Gas Revenue Tax

Electricity Excise Tax

Telecommunications Excise Tax

(liabilities on or after August 1, 1998)

Public Utilities (Electricity) Tax

Telecommunications Infrastructure Maintenance Fees

(liabilities prior to August 1, 1998)

10

Did you collect the tax checked in Item 9 from your customers?

yes

no

If “yes,” did you refund the overpayment to your customers?

yes

no

If “yes,” attach proof that the overpayment was refunded.

11

Explain all reasons why you are filing this claim. You may use the back of this form if you need additional space.

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

12

Complete the following table.

1

2

3

4

Month and year

Amount of tax paid

Subtract Column 3

of tax return on

(If paid under protest,

from Column 2.

which overpayment

write “P” to the left

Tax due

This is the amount

was paid

of the amount.)

as corrected

of credit claimed.

Official use only

__ __/__ __ __ __

$___________________ $___________________

$___________________ ____________________

__ __/__ __ __ __

$___________________ $___________________

$___________________ ____________________

__ __/__ __ __ __

$___________________ $___________________

$___________________ ____________________

__ __/__ __ __ __

$___________________ $___________________

$___________________ ____________________

__ __/__ __ __ __

$___________________ $___________________

$___________________ ____________________

__ __/__ __ __ __

$___________________ $___________________

$___________________ ____________________

__ __/__ __ __ __

$___________________ $___________________

$___________________ ____________________

__ __/__ __ __ __

$___________________ $___________________

$___________________ ____________________

__ __/__ __ __ __

$___________________ $___________________

$___________________ ____________________

__ __/__ __ __ __

$___________________ $___________________

$___________________ ____________________

__ __/__ __ __ __

$___________________ $___________________

$___________________ ____________________

__ __/__ __ __ __

$___________________ $___________________

$___________________ ____________________

13

Are you a party to any civil suit involving these amounts?

yes

no

If “yes,” write the name of the suit. _________________________________________________________________________________

Step 3: Sign below

Under penalties of perjury, I state that I have examined this refund claim and, to the best of my knowledge, it is true, correct, and complete.

________________________________________________________________________________________________________________

Claimant’s signature

Title ( e.g. , owner, partner, officer, or authorized agent)

Date

Memo no.:

Credit amt.:

Verified by:

This form is authorized by the Gas Revenue Tax Act, Electricity Excise Tax Law, Public Utilities Revenue Act, Telecommunications Excise Tax Act, Telecommunications

Municipal Infrastructure Maintenance Fee Act, and Water Company Invested Capital Tax Act. Disclosure of this information is REQUIRED. Failure to provide

Date:

information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-1754

Approved by:

IDR-85 front (R-4/01)

Date:

Reset

Print

1

1