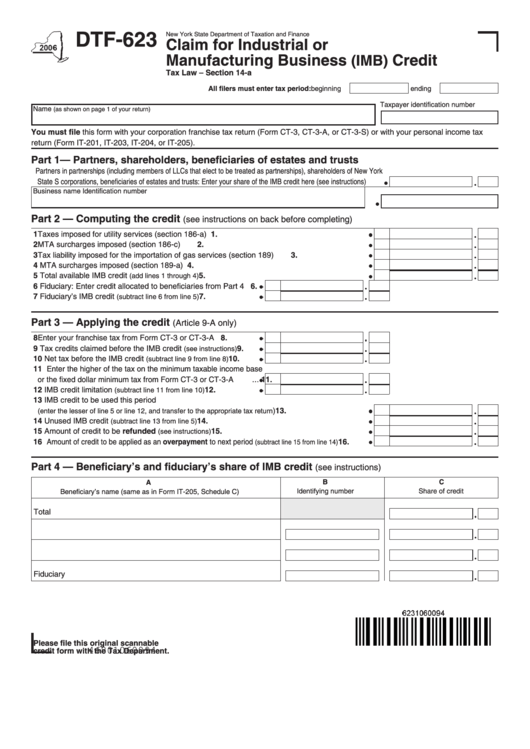

DTF-623

New York State Department of Taxation and Finance

Claim for Industrial or

Manufacturing Business

Credit

(IMB)

Tax Law – Section 14-a

All filers must enter tax period: beginning

ending

Taxpayer identification number

Name

(as shown on page 1 of your return)

You must file this form with your corporation franchise tax return (Form CT‑3, CT‑3‑A, or CT‑3‑S) or with your personal income tax

return (Form IT‑201, IT‑203, IT‑204, or IT‑205).

Part 1 — Partners, shareholders, beneficiaries of estates and trusts

Partners in partnerships (including members of LLCs that elect to be treated as partnerships), shareholders of New York

State S corporations, beneficiaries of estates and trusts: Enter your share of the IMB credit here (see instructions) ....

Business name

Identification number

Part 2 — Computing the credit

(see instructions on back before completing)

1 Taxes imposed for utility services (section 186‑a) ......................................................................

1.

2 MTA surcharges imposed (section 186‑c) ..................................................................................

2.

3 Tax liability imposed for the importation of gas services (section 189) ......................................

3.

4 MTA surcharges imposed (section 189‑a) ..................................................................................

4.

5 Total available IMB credit

..........................................................................

5.

(add lines 1 through 4)

6 Fiduciary: Enter credit allocated to beneficiaries from Part 4

6.

7 Fiduciary’s IMB credit

7.

.......................

(subtract line 6 from line 5)

Part 3 — Applying the credit

(Article 9‑A only)

8 Enter your franchise tax from Form CT‑3 or CT‑3‑A ...............

8.

9 Tax credits claimed before the IMB credit

......

9.

(see instructions)

10 Net tax before the IMB credit

...........

10.

(subtract line 9 from line 8)

11 Enter the higher of the tax on the minimum taxable income base

or the fixed dollar minimum tax from Form CT‑3 or CT‑3‑A ...

11.

12 IMB credit limitation

......................

12.

(subtract line 11 from line 10)

13 IMB credit to be used this period

) ..................................

13.

(enter the lesser of line 5 or line 12, and transfer to the appropriate tax return

14 Unused IMB credit

.............................................................................

14.

(subtract line 13 from line 5)

15 Amount of credit to be refunded

15.

......................................................................

(see instructions)

16 Amount of credit to be applied as an overpayment to next period

16.

.............

(subtract line 15 from line 14)

Part 4 — Beneficiary’s and fiduciary’s share of IMB credit

(see instructions)

B

C

A

Identifying number

Share of credit

Beneficiary’s name (same as in Form IT‑205, Schedule C)

Total

Fiduciary

Please file this original scannable

46801060094

credit form with the Tax Department.

1

1