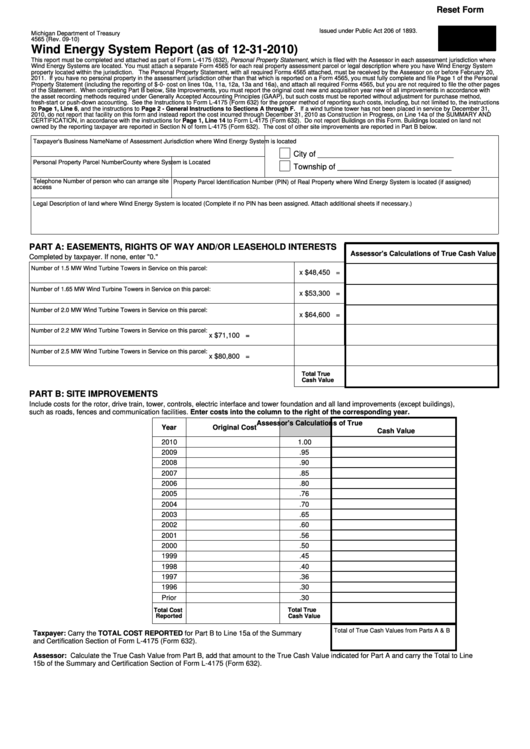

Reset Form

Issued under Public Act 206 of 1893.

2011

Michigan Department of Treasury

4565 (Rev. 09-10)

Wind Energy System Report (as of 12-31-2010)

This report must be completed and attached as part of Form L-4175 (632), Personal Property Statement, which is filed with the Assessor in each assessment jurisdiction where

Wind Energy Systems are located. You must attach a separate Form 4565 for each real property assessment parcel or legal description where you have Wind Energy System

property located within the jurisdiction. The Personal Property Statement, with all required Forms 4565 attached, must be received by the Assessor on or before February 20,

2011. If you have no personal property in the assessment jurisdiction other than that which is reported on a Form 4565, you must fully complete and file Page 1 of the Personal

Property Statement (including the reporting of $-0- cost on lines 10a, 11a, 12a, 13a and 16a), and attach all required Forms 4565, but you are not required to file the other pages

of the Statement. When completing Part B below, Site Improvements, you must report the original cost new and acquisition year new of all improvements in accordance with

the asset recording methods required under Generally Accepted Accounting Principles (GAAP), but such costs must be reported without adjustment for purchase method,

fresh-start or push-down accounting. See the Instructions to Form L-4175 (Form 632) for the proper method of reporting such costs, including, but not limited to, the instructions

to Page 1, Line 6, and the instructions to Page 2 - General Instructions to Sections A through F. If a wind turbine tower has not been placed in service by December 31,

2010, do not report that facility on this form and instead report the cost incurred through December 31, 2010 as Construction in Progress, on Line 14a of the SUMMARY AND

CERTIFICATION, in accordance with the instructions for Page 1, Line 14 to Form L-4175 (Form 632). Do not report Buildings on this Form. Buildings located on land not

owned by the reporting taxpayer are reported in Section N of form L-4175 (Form 632). The cost of other site improvements are reported in Part B below.

Taxpayer's Business Name

Name of Assessment Jurisdiction where Wind Energy System is located

City of _______________________________

Personal Property Parcel Number

County where System is Located

Township of __________________________

Telephone Number of person who can arrange site

Property Parcel Identification Number (PIN) of Real Property where Wind Energy System is located (if assigned)

access

Legal Description of land where Wind Energy System is located (Complete if no PIN has been assigned. Attach additional sheets if necessary.)

PART A: EASEMENTS, RIGHTS OF WAY AND/OR LEASEHOLD INTERESTS

Assessor's Calculations of True Cash Value

Completed by taxpayer. If none, enter "0."

Number of 1.5 MW Wind Turbine Towers in Service on this parcel:

x $48,450 =

Number of 1.65 MW Wind Turbine Towers in Service on this parcel:

x $53,300 =

Number of 2.0 MW Wind Turbine Towers in Service on this parcel:

x $64,600 =

Number of 2.2 MW Wind Turbine Towers in Service on this parcel:

x $71,100 =

Number of 2.5 MW Wind Turbine Towers in Service on this parcel:

x $80,800 =

Total True

Cash Value

PART B: SITE IMPROVEMENTS

Include costs for the rotor, drive train, tower, controls, electric interface and tower foundation and all land improvements (except buildings),

such as roads, fences and communication facilities. Enter costs into the column to the right of the corresponding year.

Assessor's Calculations of True

Year

Original Cost

Cash Value

2010

1.00

2009

.95

2008

.90

2007

.85

2006

.80

2005

.76

2004

.70

2003

.65

2002

.60

2001

.56

2000

.50

1999

.45

1998

.40

1997

.36

1996

.30

Prior

.30

Total Cost

Total True

Reported

Cash Value

Total of True Cash Values from Parts A & B

Taxpayer: Carry the TOTAL COST REPORTED for Part B to Line 15a of the Summary

and Certification Section of Form L-4175 (Form 632).

Assessor: Calculate the True Cash Value from Part B, add that amount to the True Cash Value indicated for Part A and carry the Total to Line

15b of the Summary and Certification Section of Form L-4175 (Form 632).

1

1