Michigan Department of Treasury

4565 (Rev. 11-12)

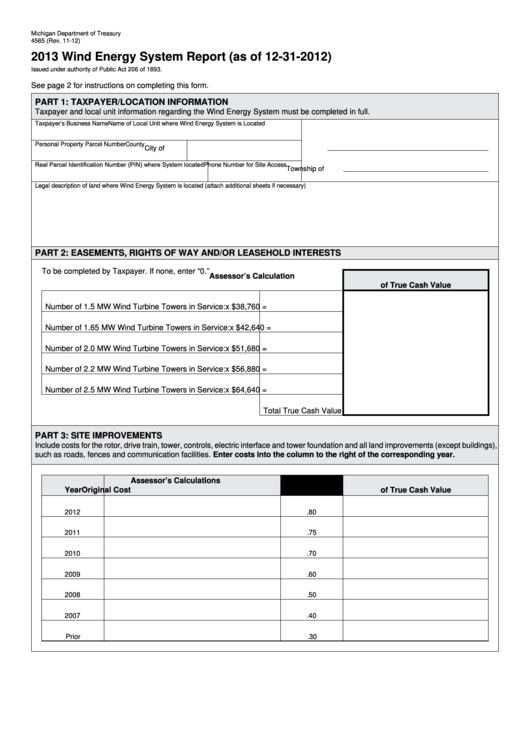

2013 Wind Energy System Report (as of 12-31-2012)

Issued under authority of Public Act 206 of 1893.

See page 2 for instructions on completing this form.

PaRt 1: taxPayER/Location infoRmation

Taxpayer and local unit information regarding the Wind Energy System must be completed in full.

Taxpayer’s Business Name

Name of Local Unit where Wind Energy System is Located

Personal Property Parcel Number

County

City of

Real Parcel Identification Number (PIN) where System located

Phone Number for Site Access

Township of

Legal description of land where Wind Energy System is located (attach additional sheets if necessary)

PaRt 2: EaSEmEntS, RightS of Way and/oR LEaSEhoLd intEREStS

To be completed by Taxpayer. If none, enter “0.”

assessor’s calculation

of true cash Value

Number of 1.5 MW Wind Turbine Towers in Service:

x $38,760 =

Number of 1.65 MW Wind Turbine Towers in Service:

x $42,640 =

Number of 2.0 MW Wind Turbine Towers in Service:

x $51,680 =

Number of 2.2 MW Wind Turbine Towers in Service:

x $56,880 =

Number of 2.5 MW Wind Turbine Towers in Service:

x $64,640 =

Total True Cash Value

PaRt 3: SitE imPRoVEmEntS

Include costs for the rotor, drive train, tower, controls, electric interface and tower foundation and all land improvements (except buildings),

such as roads, fences and communication facilities. Enter costs into the column to the right of the corresponding year.

assessor’s calculations

year

original cost

of true cash Value

2012

.80

2011

.75

2010

.70

2009

.60

2008

.50

2007

.40

Prior

.30

1

1 2

2