Form Ct-1120 Pic - Information Return For Passive Investment Companies - 2005

ADVERTISEMENT

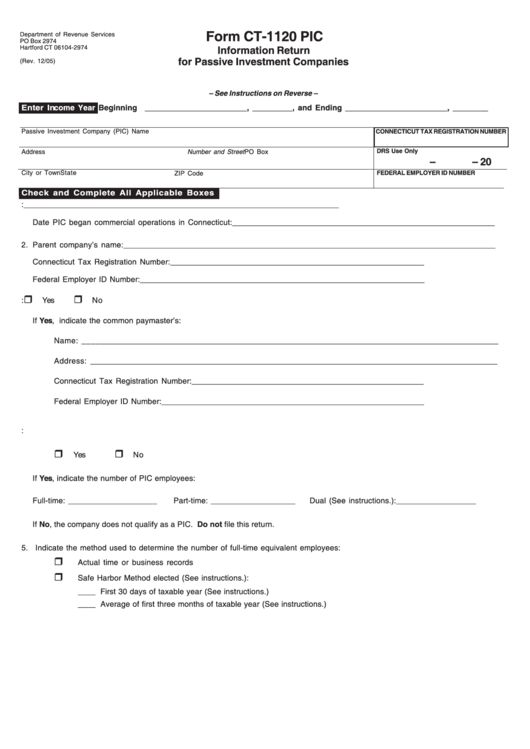

Form CT-1120 PIC

Department of Revenue Services

PO Box 2974

Hartford CT 06104-2974

Information Return

for Passive Investment Companies

(Rev. 12/05)

– See Instructions on Reverse –

Enter Income Year

Beginning

_______________________, _________, and Ending _______________________, ________

Passive Investment Company (PIC) Name

CONNECTICUT TAX REGISTRATION NUMBER

DRS Use Only

Address

Number and Street

PO Box

–

– 20

City or Town

State

FEDERAL EMPLOYER ID NUMBER

ZIP Code

Check and Complete All Applicable Boxes

1. Date PIC began commercial operations: ________________________________________________________________________

Date PIC began commercial operations in Connecticut: ____________________________________________________________

2. Parent company’s name: _____________________________________________________________________________________

Connecticut Tax Registration Number: __________________________________________________________

Federal Employer ID Number: _________________________________________________________________

3. Is a common paymaster used:

Yes

No

If Yes, indicate the common paymaster’s:

Name: _______________________________________________________________________________________________

Address: _____________________________________________________________________________________________

Connecticut Tax Registration Number: _____________________________________________________

Federal Employer ID Number: ____________________________________________________________

4. Did the PIC have at least five full-time equivalent employees in Connecticut for the period covered by this return:

Yes

No

If Yes, indicate the number of PIC employees:

Full-time: ____________________

Part-time: ___________________

Dual (See instructions.):__________________

If No, the company does not qualify as a PIC. Do not file this return.

5.

Indicate the method used to determine the number of full-time equivalent employees:

Actual time or business records

Safe Harbor Method elected (See instructions.):

____ First 30 days of taxable year (See instructions.)

____ Average of first three months of taxable year (See instructions.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2