Form Ct-1120 Pic - Connecticut Information Return For Passive Investment Companies

ADVERTISEMENT

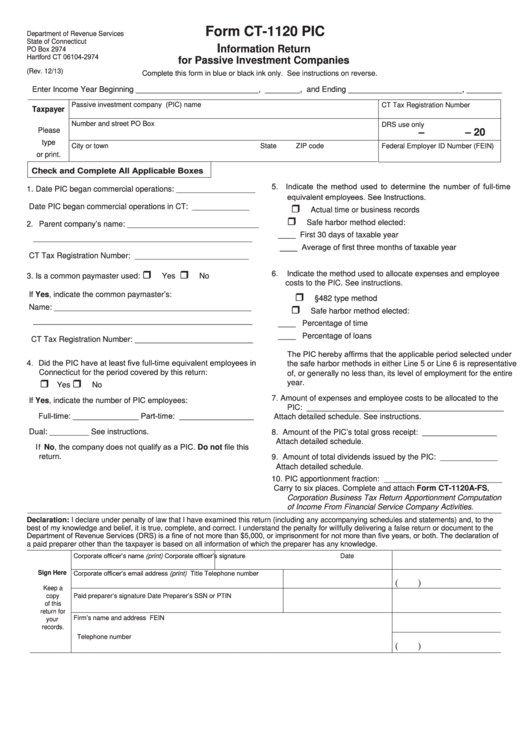

Form CT-1120 PIC

Department of Revenue Services

State of Connecticut

I

nformation Return

PO Box 2974

Hartford CT 06104-2974

for Passive Investment Companies

(Rev. 12/13)

Complete this form in blue or black ink only. See instructions on reverse.

Enter Income Year Beginning ____________________________, ________, and Ending __________________________, ________

Passive investment company (PIC) name

CT Tax Registration Number

Taxpayer

Number and street

PO Box

DRS use only

Please

–

– 20

type

City or town

State

ZIP code

Federal Employer ID Number (FEIN)

or print.

Check and Complete All Applicable Boxes

5. Indicate the method used to determine the number of full-time

1. Date PIC began commercial operations: __________________

equivalent employees. See Instructions.

Date PIC began commercial operations in CT: _____________

Actual time or business records

Safe harbor method elected:

2. Parent company’s name: ______________________________

____ First 30 days of taxable year

__________________________________________________

____ Average of first three months of taxable year

CT Tax Registration Number: __________________________

6.

Indicate the method used to allocate expenses and employee

3. Is a common paymaster used:

Yes

No

costs to the PIC. See instructions.

If Yes, indicate the common paymaster’s:

I.R.C. §482 type method

Name: _____________________________________________

Safe harbor method elected:

__________________________________________________

____ Percentage of time

____ Percentage of loans

CT Tax Registration Number: ___________________________

The PIC hereby affirms that the applicable period selected under

4. Did the PIC have at least five full-time equivalent employees in

the safe harbor methods in either Line 5 or Line 6 is representative

Connecticut for the period covered by this return:

of, or generally no less than, its level of employment for the entire

year.

Yes

No

7.

Amount of expenses and employee costs to be allocated to the

If Yes, indicate the number of PIC employees:

PIC: _____________________________________________

Full-time: _______________ Part-time: _________________

Attach detailed schedule. See instructions.

Dual: _________ See instructions.

8.

Amount of the PIC’s total gross receipt: _________________

Attach detailed schedule.

If No, the company does not qualify as a PIC. Do not file this

return.

9.

Amount of total dividends issued by the PIC: _____________

Attach detailed schedule.

10. PIC apportionment fraction: ___________________________

Carry to six places. Complete and attach Form CT-1120A-FS,

Corporation Business Tax Return Apportionment Computation

of Income From Financial Service Company Activities.

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the

best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to the

Department of Revenue Services (DRS) is a fine of not more than $5,000, or imprisonment for not more than five years, or both. The declaration of

a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Corporate officer’s name (print)

Corporate officer’s signature

Date

Corporate officer’s email address (print)

Sign Here

Title

Telephone number

(

)

Keep a

Paid preparer’s signature

Date

Preparer’s SSN or PTIN

copy

of this

return for

Firm’s name and address

FEIN

your

records.

Telephone number

(

)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3