Application For Income Tax Refund Form - City Of North Ridgeville, Ohio

ADVERTISEMENT

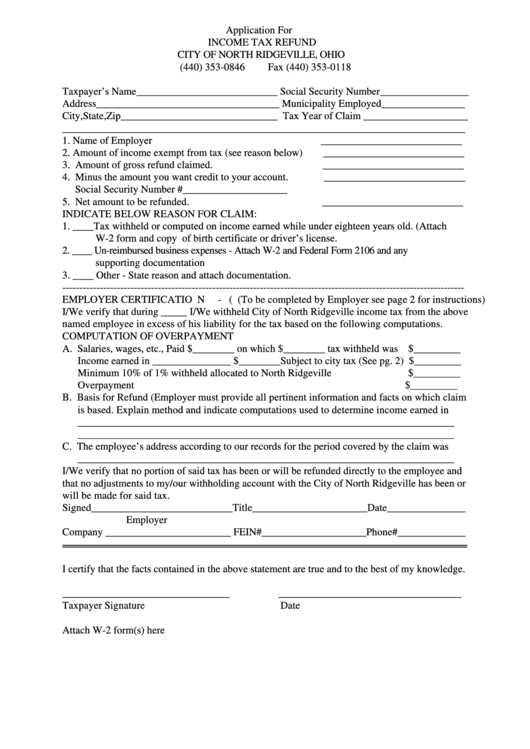

Application For

INCOME TAX REFUND

CITY OF NORTH RIDGEVILLE, OHIO

(440) 353-0846

Fax (440) 353-0118

Taxpayer’s Name___________________________ Social Security Number_________________

Address___________________________________ Municipality Employed________________

City,State,Zip______________________________ Tax Year of Claim ____________________

_____________________________________________________________________________

1. Name of Employer

___________________________

2. Amount of income exempt from tax (see reason below)

___________________________

3. Amount of gross refund claimed.

___________________________

4. Minus the amount you want credit to your account.

___________________________

Social Security Number #____________________

5. Net amount to be refunded.

___________________________

INDICATE BELOW REASON FOR CLAIM:

1. ____Tax withheld or computed on income earned while under eighteen years old. (Attach

W-2 form and copy of birth certificate or driver’s license.

2. ____ Un-reimbursed business expenses - Attach W-2 and Federal Form 2106 and any

supporting documentation

3. ____ Other - State reason and attach documentation.

----------------------------------------------------------------------------------------------------------------------

EMPLOYER CERTIFICATIO N - ( (To be completed by Employer see page 2 for instructions)

I/We verify that during _____ I/We withheld City of North Ridgeville income tax from the above

named employee in excess of his liability for the tax based on the following computations.

COMPUTATION OF OVERPAYMENT

A. Salaries, wages, etc., Paid $________ on which $________ tax withheld was $_________

Income earned in _______________ $________Subject to city tax (See pg. 2) $_________

Minimum 10% of 1% withheld allocated to North Ridgeville

$_________

Overpayment

$_________

B. Basis for Refund (Employer must provide all pertinent information and facts on which claim

is based. Explain method and indicate computations used to determine income earned in

________________________________________________________________________

________________________________________________________________________

C. The employee’s address according to our records for the period covered by the claim was

________________________________________________________________________

I/We verify that no portion of said tax has been or will be refunded directly to the employee and

that no adjustments to my/our withholding account with the City of North Ridgeville has been or

will be made for said tax.

Signed___________________________Title______________________Date_______________

Employer

Company ________________________ FEIN#____________________Phone#_____________

I certify that the facts contained in the above statement are true and to the best of my knowledge.

________________________________

___________________________________

Taxpayer Signature

Date

Attach W-2 form(s) here

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2