Form Ar321 - Estate Tax Return 1999 - Arkansas 1999

ADVERTISEMENT

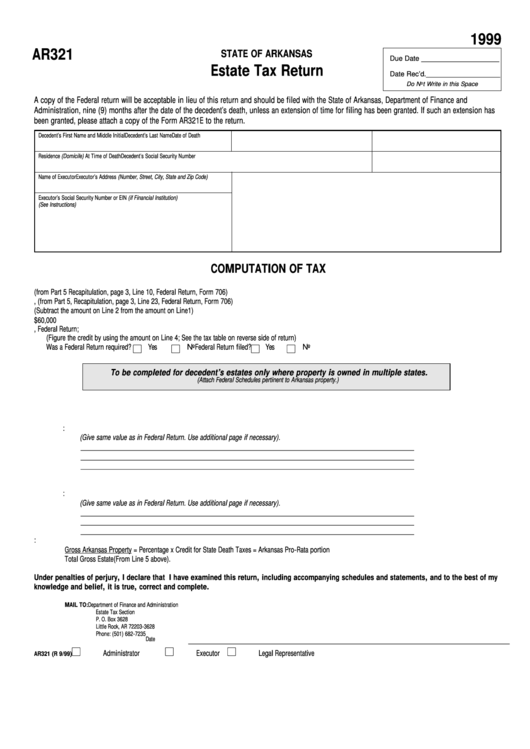

1999

AR321

STATE OF ARKANSAS

Due Date ____________________

Estate Tax Return

Date Rec’d. ___________________

Do Not Write in this Space

A copy of the Federal return will be acceptable in lieu of this return and should be filed with the State of Arkansas, Department of Finance and

Administration, nine (9) months after the date of the decedent’s death, unless an extension of time for filing has been granted. If such an extension has

been granted, please attach a copy of the Form AR321E to the return.

Decedent’s First Name and Middle Initial

Decedent’s Last Name

Date of Death

Residence (Domicile) At Time of Death

Decedent’s Social Security Number

Name of Executor

Executor’s Address (Number, Street, City, State and Zip Code)

Executor’s Social Security Number or EIN (if Financial Institution)

(See Instructions)

COMPUTATION OF TAX

1. Total gross estate (from Part 5 Recapitulation, page 3, Line 10, Federal Return, Form 706)..................................................................

1.

__________________

2. Total allowable deductions, (from Part 5, Recapitulation, page 3, Line 23, Federal Return, Form 706)..................................................

2.

__________________

3. Taxable estate. (Subtract the amount on Line 2 from the amount on Line1)...........................................................................................

3.

__________________

4. Taxable estate less $60,000 deduction. ..................................................................................................................................................

4.

__________________

5. Credit for State death taxes not to exceed the amount on Line 15, Federal Return;

(Figure the credit by using the amount on Line 4; See the tax table on reverse side of return)..............................................................

5.

__________________

Was a Federal Return required?

Yes

No

Federal Return filed?

Yes

No

To be completed for decedent’s estates only where property is owned in multiple states.

(Attach Federal Schedules pertinent to Arkansas property.)

6. Total value of real estate in Arkansas as valued in Federal Return..........................................................................................................

6.

__________________

7. Total value of real estate in other states..................................................................................................................................................

7.

__________________

a.

Give name of state and value in each state:

(Give same value as in Federal Return. Use additional page if necessary).

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

8. Total value of personal property of every kind in Arkansas as valued in Federal Return.........................................................................

8.

__________________

9. Total value of personal property in other states. .....................................................................................................................................

9.

__________________

a.

Give name of state and value in each state:

(Give same value as in Federal Return. Use additional page if necessary).

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

10. Arkansas Pro-Rata portion of Credit for State Death Taxes:.................................................................................................................... 10.

__________________

Gross Arkansas Property = Percentage x Credit for State Death Taxes = Arkansas Pro-Rata portion

Total Gross Estate

(From Line 5 above).

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct and complete.

MAIL TO:

Department of Finance and Administration

Estate Tax Section

P. O. Box 3628

Little Rock, AR 72203-3628

Phone: (501) 682-7235

Date

________________________________________________________________________________

Administrator

Executor

Legal Representative

AR321 (R 9/99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1