Print and Reset Form

Reset Form

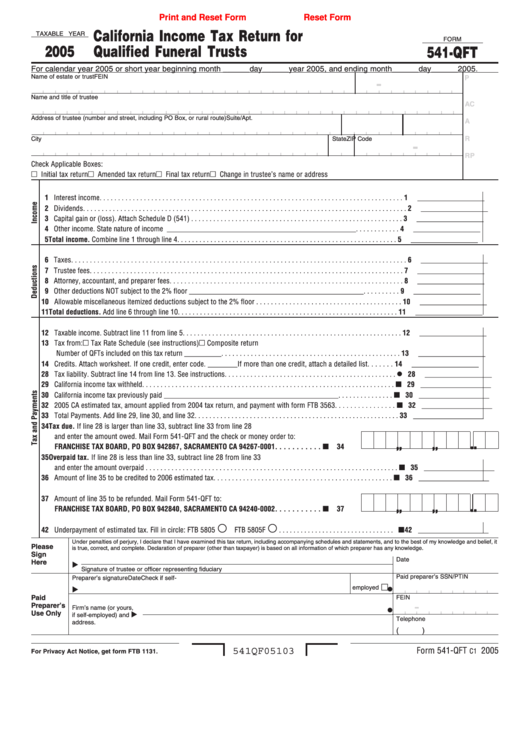

California Income Tax Return for

TAXABLE YEAR

FORM

2005

Qualified Funeral Trusts

541-QFT

For calendar year 2005 or short year beginning month ______day______year 2005, and ending month______day______2005.

Name of estate or trust

FEIN

P

-

Name and title of trustee

AC

Address of trustee (number and street, including PO Box, or rural route)

Suite/Apt. no.

PMB no.

A

R

City

State

ZIP Code

-

RP

Check Applicable Boxes:

Initial tax return

Amended tax return

Final tax return

Change in trustee’s name or address

1 Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

__________________

2 Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

__________________

3 Capital gain or (loss). Attach Schedule D (541) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

__________________

4 Other income. State nature of income ___________________________________________________ . . . . . . . . . . . .

4

__________________

5 Total income. Combine line 1 through line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

__________________

6 Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

__________________

7 Trustee fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

__________________

8 Attorney, accountant, and preparer fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

__________________

9 Other deductions NOT subject to the 2% floor _______________________________________________ . . . . . . . . . .

9

__________________

10 Allowable miscellaneous itemized deductions subject to the 2% floor . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

__________________

11 Total deductions. Add line 6 through line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

__________________

12 Taxable income. Subtract line 11 from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

__________________

13 Tax from:

Tax Rate Schedule (see instructions)

Composite return

Number of QFTs included on this tax return __________ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

__________________

14 Credits. Attach worksheet. If one credit, enter code. ________ If more than one credit, attach a detailed list . . . . . . .

14

__________________

•

28 Tax liability. Subtract line 14 from line 13. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

__________________

29 California income tax withheld . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29 ___________________

30 California income tax previously paid _______________________________________________ . . . . . . . . . . . . . . .

30 ___________________

32 2005 CA estimated tax, amount applied from 2004 tax return, and payment with form FTB 3563 . . . . . . . . . . . . . . . .

32 ___________________

33 Total Payments. Add line 29, line 30, and line 32 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33 ___________________

34 Tax due. If line 28 is larger than line 33, subtract line 33 from line 28

and enter the amount owed. Mail Form 541-QFT and the check or money order to:

. . . . .

, , , , ,

, , , , ,

FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0001 . . . . . . . . . . .

34

35 Overpaid tax. If line 28 is less than line 33, subtract line 28 from line 33

and enter the amount overpaid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

35 ___________________

36 Amount of line 35 to be credited to 2006 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

36 ___________________

37 Amount of line 35 to be refunded. Mail Form 541-QFT to:

. . . . .

, , , , ,

, , , , ,

FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO CA 94240-0002 . . . . . . . . . . .

37

42 Underpayment of estimated tax. Fill in circle: FTB 5805

FTB 5805F

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

42 ___________________

Under penalties of perjury, I declare that I have examined this tax return, including accompanying schedules and statements, and to the best of my knowledge and belief, it

Please

is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign

Date

Here

Signature of trustee or officer representing fiduciary

Paid preparer’s SSN/PTIN

Preparer’s signature

Date

Check if self-

•

employed

Paid

FEIN

-

Preparer’s

Firm’s name (or yours,

•

Use Only

if self-employed) and

Telephone

address.

(

)

Form 541-QFT

2005

541QF05103

C1

For Privacy Act Notice, get form FTB 1131.

1

1