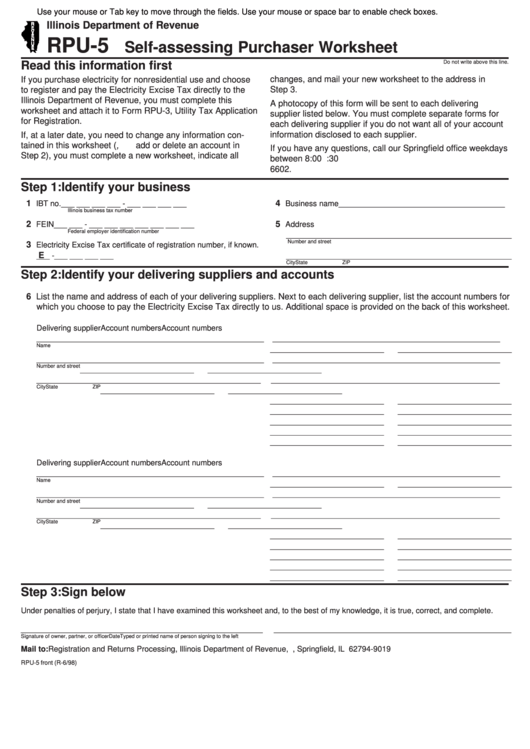

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

RPU-5

Self-assessing Purchaser Worksheet

Do not write above this line.

Read this information first

changes, and mail your new worksheet to the address in

If you purchase electricity for nonresidential use and choose

to register and pay the Electricity Excise Tax directly to the

Step 3.

Illinois Department of Revenue, you must complete this

A photocopy of this form will be sent to each delivering

worksheet and attach it to Form RPU-3, Utility Tax Application

supplier listed below. You must complete separate forms for

for Registration.

each delivering supplier if you do not want all of your account

information disclosed to each supplier.

If, at a later date, you need to change any information con-

tained in this worksheet ( e.g., add or delete an account in

If you have any questions, call our Springfield office weekdays

Step 2), you must complete a new worksheet, indicate all

between 8:00 a.m. and 4:30 p.m. at 217 524-5406 or 217 785-

6602.

Step 1: Identify your business

1

4

IBT no. ___ ___ ___ ___ - ___ ___ ___ ___

Business name ______________________________________

Illinois business tax number

2

5

FEIN

___ ___ - ___ ___ ___ ___ ___ ___ ___

Address

Federal employer identification number

___________________________________________________

Number and street

3

Electricity Excise Tax certificate of registration number, if known.

E

___ -___ ___ ___ ___

___________________________________________________

City

State

ZIP

Step 2: Identify your delivering suppliers and accounts

6 List the name and address of each of your delivering suppliers. Next to each delivering supplier, list the account numbers for

which you choose to pay the Electricity Excise Tax directly to us. Additional space is provided on the back of this worksheet.

Delivering supplier

Account numbers

Account numbers

____________________________________________________

__________________________

__________________________

Name

__________________________

__________________________

____________________________________________________

__________________________

__________________________

Number and street

__________________________

__________________________

___________________________________________________

__________________________

__________________________

City

State

ZIP

__________________________

__________________________

__________________________

__________________________

__________________________

__________________________

__________________________

__________________________

__________________________

__________________________

__________________________

__________________________

Delivering supplier

Account numbers

Account numbers

____________________________________________________

__________________________

__________________________

Name

__________________________

__________________________

____________________________________________________

__________________________

__________________________

Number and street

__________________________

__________________________

___________________________________________________

__________________________

__________________________

City

State

ZIP

__________________________

__________________________

__________________________

__________________________

__________________________

__________________________

__________________________

__________________________

__________________________

__________________________

__________________________

__________________________

Step 3: Sign below

Under penalties of perjury, I state that I have examined this worksheet and, to the best of my knowledge, it is true, correct, and complete.

_______________________________________________________

______________________________________________________

Signature of owner, partner, or officer

Date

Typed or printed name of person signing to the left

Mail to: Registration and Returns Processing, Illinois Department of Revenue, P.O. Box 19019, Springfield, IL 62794-9019

RPU-5 front (R-6/98)

1

1 2

2