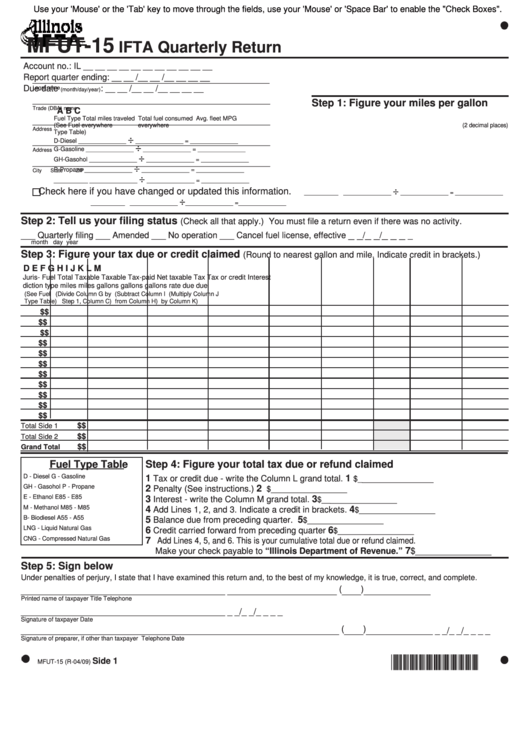

Use your 'Mouse' or the 'Tab' key to move through the fields, use your 'Mouse' or 'Space Bar' to enable the "Check Boxes".

MFUT-15

IFTA Quarterly Return

Account no.: IL __ __ __ __ __ __ __ __ __ __ __

Report quarter ending: __ __ /__ __ /__ __ __ __

_________________________________________________

Due date

: __ __ /__ __ /__ __ __ __

Legal name

(month/day/year)

__________________________________________________

Step 1: Figure your miles per gallon

Trade (DBA) name

A

B

C

Fuel Type

Total miles traveled Total fuel consumed

Avg. fleet MPG

__________________________________________________

(See Fuel

everywhere

everywhere

(2 decimal places)

Address

Type Table)

÷

__________________________________________________

D-Diesel

______________

______________ = ______________

÷

G-Gasoline

______________

______________ = ______________

Address

÷

GH-Gasohol ______________

______________ = ______________

__________________________________________________

÷

P-Propane

______________

______________ = ______________

City

State

ZIP

÷

__________ ______________

______________ = ______________

÷

Check here if you have changed or updated this information.

__________ ______________

______________ = ______________

÷

__________ ______________

______________ =______________

Step 2: Tell us your filing status

(Check all that apply.) You must file a return even if there was no activity.

_ _

_ _

_ _ _

___ Quarterly filing

___ Amended

___ No operation

___ Cancel fuel license, effective

/

/

_

month day

year

Step 3: Figure your tax due or credit claimed

(Round to nearest gallon and mile. Indicate credit in brackets.)

D

E

F

G

H

I

J

K

L

M

Juris-

Fuel

Total

Taxable

Taxable

Tax-paid

Net taxable

Tax

Tax or credit

Interest

diction

type

miles

miles

gallons

gallons

gallons

rate

due

due

(See Fuel

(Divide Column G by

(Subtract Column I

(Multiply Column J

Type Table)

Step 1, Column C)

from Column H)

by Column K)

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

Total Side 1

$

$

Total Side 2

$

$

Grand Total

Fuel Type Table

Step 4: Figure your total tax due or refund claimed

D - Diesel

G - Gasoline

1

1

Tax or credit due - write the Column L grand total.

_______________

$_

GH - Gasohol

P - Propane

2

2

Penalty (See instructions.)

________________

$

E - Ethanol

E85 - E85

3

3

Interest - write the Column M grand total.

______________

$__

M - Methanol

M85 - M85

4

4

Add Lines 1, 2, and 3. Indicate a credit in brackets.

________________

$

B- Biodiesel

A55 - A55

5

5

Balance due from preceding quarter.

________________

$

LNG - Liquid Natural Gas

6

6

Credit carried forward from preceding quarter

________________

$

CNG - Compressed Natural Gas

7

Add Lines 4, 5, and 6. This is your cumulative total due or refund claimed.

7

Make your check payable to “Illinois Department of Revenue.”

$________________

Step 5: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

___________________________________________ _______________________ ( ____ ) ______________

Printed name of taxpayer

Title

Telephone

___________________________________________ _ _/_ _/_ _ _ _

Signature of taxpayer

Date

___________________________________________________________________ ( ____ ) ______________ _ _/_ _/_ _ _ _

Signature of preparer, if other than taxpayer

Telephone

Date

*909701110*

Side 1

MFUT-15 (R-04/09)

1

1 2

2