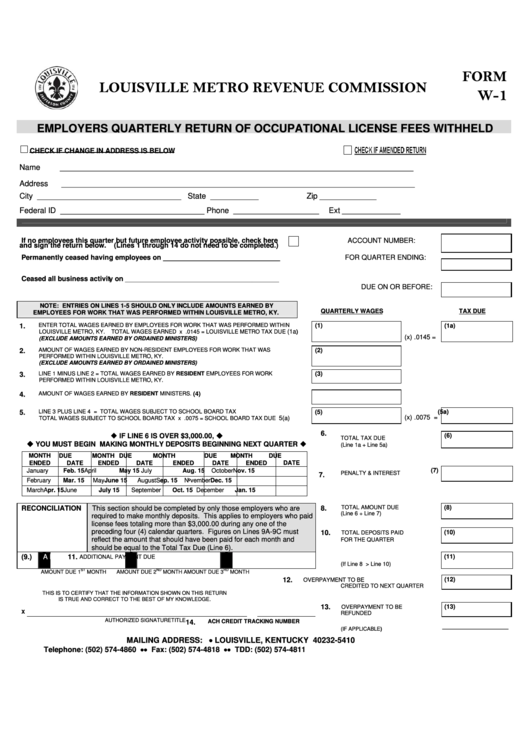

Form W-1 - Employers Quarterly Return Of Occupational License Fees Withheld

ADVERTISEMENT

FORM

LOUISVILLE METRO REVENUE COMMISSION

1

W-

EMPLOYERS QUARTERLY RETURN OF OCCUPATIONAL LICENSE FEES WITHHELD

CHECK IF CHANGE IN ADDRESS IS BELOW

Name

_________________________________________________________________________________

Address

_________________________________________________________________________________

City

_________________________________

State ___________

Zip _____________

Federal ID _________________________________

Phone

Ext

______________________

_______________

If no employees this quarter but future employee activity possible, check here

ACCOUNT NUMBER:

and sign the return below.

(Lines 1 through 14 do not need to be completed.)

Permanently ceased having employees on ______________________________

FOR QUARTER ENDING:

Ceased all business activity on ________________________________________

DUE ON OR BEFORE:

NOTE: ENTRIES ON LINES 1-5 SHOULD ONLY INCLUDE AMOUNTS EARNED BY

QUARTERLY WAGES

TAX DUE

EMPLOYEES FOR WORK THAT WAS PERFORMED WITHIN LOUISVILLE METRO, KY.

ENTER TOTAL WAGES EARNED BY EMPLOYEES FOR WORK THAT WAS PERFORMED WITHIN

1.

(1)

(1a)

LOUISVILLE METRO, KY.

TOTAL WAGES EARNED x .0145 = LOUISVILLE METRO TAX DUE

(1a

)

(x) .0145 =

(EXCLUDE AMOUNTS EARNED BY ORDAINED MINISTERS)

AMOUNT OF WAGES EARNED BY NON-RESIDENT EMPLOYEES FOR WORK THAT WAS

(2)

2.

PERFORMED WITHIN LOUISVILLE METRO, KY.

(EXCLUDE AMOUNTS EARNED BY ORDAINED MINISTERS)

LINE 1 MINUS LINE 2 = TOTAL WAGES EARNED BY RESIDENT EMPLOYEES FOR WORK

(3)

3.

PERFORMED WITHIN LOUISVILLE METRO, KY.

AMOUNT OF WAGES EARNED BY RESIDENT MINISTERS.

4.

(4)

5.

LINE 3 PLUS LINE 4 = TOTAL WAGES SUBJECT TO SCHOOL BOARD TAX

(5)

(5a)

(x) .0075 =

5(a)

TOTAL WAGES SUBJECT TO SCHOOL BOARD TAX x .0075 = SCHOOL BOARD TAX DUE

IF LINE 6 IS OVER $3,000.00,

(6)

TOTAL TAX DUE

6.

YOU MUST BEGIN MAKING MONTHLY DEPOSITS BEGINNING NEXT QUARTER

(Line 1a + Line 5a)

MONTH

DUE

MONTH

DUE

MONTH

DUE

MONTH

DUE

ENDED

DATE

ENDED

DATE

ENDED

DATE

ENDED

DATE

(7)

January

Feb. 15

April

May 15

July

Aug. 15

October

Nov. 15

PENALTY & INTEREST

7.

February

May

August

November

Mar. 15

June 15

Sep. 15

Dec. 15

March

Apr. 15

June

July 15

September

Oct. 15

December

Jan. 15

TOTAL AMOUNT DUE

RECONCILIATION

This section should be completed by only those employers who are

8.

(8)

(Line 6 + Line 7)

required to make monthly deposits. This applies to employers who paid

license fees totaling more than $3,000.00 during any one of the

preceding four (4) calendar quarters. Figures on Lines 9A-9C must

10.

(10)

TOTAL DEPOSITS PAID

reflect the amount that should have been paid for each month and

FOR THE QUARTER

should be equal to the Total Tax Due (Line 6).

(9.)

A

B

C

11.

(11)

ADDITIONAL PAYMENT DUE

(If Line 8 > Line 10)

ST

ND

RD

AMOUNT DUE 1

MONTH

AMOUNT DUE 2

MONTH

AMOUNT DUE 3

MONTH

12.

(12)

OVERPAYMENT TO BE

CREDITED TO NEXT QUARTER

THIS IS TO CERTIFY THAT THE INFORMATION SHOWN ON THIS RETURN

IS TRUE AND CORRECT TO THE BEST OF MY KNOWLEDGE.

13.

(13)

OVERPAYMENT TO BE

X

REFUNDED

AUTHORIZED SIGNATURE

TITLE

14.

ACH CREDIT TRACKING NUMBER

__________________

(IF APPLICABLE)

MAILING ADDRESS: P.O. BOX 35410 • LOUISVILLE, KENTUCKY 40232-5410

Telephone: (502) 574-4860 • • Fax: (502) 574-4818 • • TDD: (502) 574-4811

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2