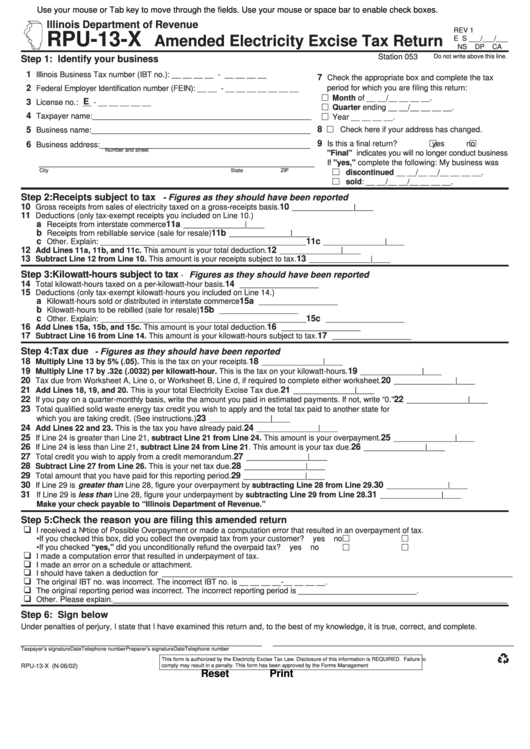

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

REV 1

RPU-13-X

Amended Electricity Excise Tax Return

E S ___/___/___

NS

DP

CA

Station 053

Do not write above this line.

Step 1: Identify your business

1

Illinois Business Tax number (IBT no.): __ __ __ __ - __ __ __ __

7

Check the appropriate box and complete the tax

2

period for which you are filing this return:

Federal Employer Identification number (FEIN): __ __ - __ __ __ __ __ __ __

Month of __ __/__ __ __ __.

E

3

License no.: __ - __ __ __ __ __

Quarter ending __ __/__ __ __ __.

4

Taxpayer name: __________________________________________________

Year __ __ __ __.

5

8

Check here if your address has changed.

Business name: __________________________________________________

9

Is this a final return?

yes

no

6

Business address: ________________________________________________

Number and street

"Final” indicates you will no longer conduct business

If "yes," complete the following: My business was

_______________________________________________________________

City

State

ZIP

discontinued __ __/__ __/__ __ __ __.

sold: __ __/__ __/__ __ __ __.

Step 2: Receipts subject to tax

- Figures as they should have been reported

10

10

Gross receipts from sales of electricity taxed on a gross-receipts basis.

______________|____

11

Deductions (only tax-exempt receipts you included on Line 10.)

a

11a

Receipts from interstate commerce

______________|____

b

11b

Receipts from rebillable service (sale for resale)

______________|____

c

11c

Other. Explain: _______________________________________________

______________|____

12

12

Add Lines 11a, 11b, and 11c. This amount is your total deduction.

______________|____

13

13

Subtract Line 12 from Line 10. This amount is your receipts subject to tax.

______________|____

Step 3: Kilowatt-hours subject to tax

Figures as they should have been reported

-

14

14

Total kilowatt-hours taxed on a per-kilowatt-hour basis.

__________________

15

Deductions (only tax-exempt kilowatt-hours you included on Line 14.)

a

15a

Kilowatt-hours sold or distributed in interstate commerce

__________________

b

15b

Kilowatt-hours to be rebilled (sale for resale)

__________________

c

15c

Other. Explain: _______________________________________________

__________________

16

16

Add Lines 15a, 15b, and 15c. This amount is your total deduction.

__________________

17

17

Subtract Line 16 from Line 14. This amount is your kilowatt-hours subject to tax.

__________________

Step 4: Tax due

- Figures as they should have been reported

18

18

Multiply Line 13 by 5% (.05). This is the tax on your receipts.

______________|____

19

19

Multiply Line 17 by .32¢ (.0032) per kilowatt-hour. This is the tax on your kilowatt-hours.

______________|____

20

20

Tax due from Worksheet A, Line o, or Worksheet B, Line d, if required to complete either worksheet.

______________|____

21

21

Add Lines 18, 19, and 20. This is your total Electricity Excise Tax due.

______________|____

22

22

If you pay on a quarter-monthly basis, write the amount you paid in estimated payments. If not, write “0.”

______________|____

23

Total qualified solid waste energy tax credit you wish to apply and the total tax paid to another state for

23

which you are taking credit. (See instructions.)

______________|____

24

24

Add Lines 22 and 23. This is the tax you have already paid.

______________|____

25

25

If Line 24 is greater than Line 21, subtract Line 21 from Line 24. This amount is your overpayment.

______________|____

26

26

If Line 24 is less than Line 21, subtract Line 24 from Line 21. This amount is your tax due.

______________|____

27

27

Total credit you wish to apply from a credit memorandum.

______________|____

28

28

Subtract Line 27 from Line 26. This is your net tax due.

______________|____

29

29

Total amount that you have paid for this reporting period.

______________|____

30

30

If Line 29 is greater than Line 28, figure your overpayment by subtracting Line 28 from Line 29.

______________|____

31

If Line 29 is less than Line 28, figure your underpayment by subtracting Line 29 from Line 28.

31

______________|____

Make your check payable to “Illinois Department of Revenue.”

Step 5: Check the reason you are filing this amended return

I received a Notice of Possible Overpayment or made a computation error that resulted in an overpayment of tax.

• If you checked this box, did you collect the overpaid tax from your customer?

yes

no

• If you checked “yes,” did you unconditionally refund the overpaid tax?

yes

no

I made a computation error that resulted in underpayment of tax.

I made an error on a schedule or attachment.

I should have taken a deduction for ________________________________________________________________________________

The original IBT no. was incorrect. The incorrect IBT no. is __ __ __ __-__ __ __ __.

The original reporting period was incorrect. The incorrect reporting period is ___________________________.

Other. Please explain.__________________________________________________________________________________________

Step 6: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

_______________________________________________________

_______________________________________________________

Taxpayer’s signature

Date

Telephone number

Preparer’s signature

Date

Telephone number

This form is authorized by the Electricity Excise Tax Law. Disclosure of this information is REQUIRED. Failure to

RPU-13-X (N-06/02)

comply may result in a penalty. This form has been approved by the Forms Management Center.

IL-492-4254

Reset

Print

1

1 2

2