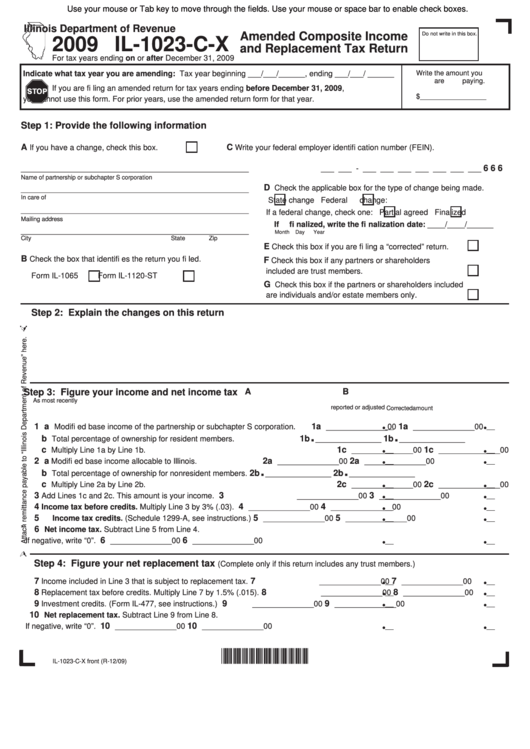

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Amended Composite Income

Do not write in this box.

2009 IL-1023-C-X

and Replacement Tax Return

For tax years ending on or after December 31, 2009

Indicate what tax year you are amending: Tax year beginning ___/___/______, ending ___/___/ ______

Write the amount you

are paying.

If you are fi ling an amended return for tax years ending before December 31, 2009,

$_________________

you cannot use this form. For prior years, use the amended return form for that year.

Step 1: Provide the following information

A

C

If you have a change, check this box.

Write your federal employer identifi cation number (FEIN).

6 6 6

____________________________________________________

___ ___ - ___ ___ ___ ___ ___ ___ ___

Name of partnership or subchapter S corporation

D

Check the applicable box for the type of change being made.

____________________________________________________

In care of

State change

Federal change:

____________________________________________________

If a federal change, check one:

Partial agreed

Finalized

Mailing address

If fi nalized, write the fi nalization date: ____/____/______

____________________________________________________

Month

Day

Year

City

State

Zip

E

Check this box if you are fi ling a “corrected” return.

B

Check the box that identifi es the return you fi led.

F

Check this box if any partners or shareholders

included are trust members.

Form IL-1065

Form IL-1120-ST

G

Check this box if the partners or shareholders included

are individuals and/or estate members only.

Step 2: Explain the changes on this return

Step 3: Figure your income and net income tax

A

B

As most recently

reported or adjusted

Corrected amount

1 a

1a

1a

Modifi ed base income of the partnership or subchapter S corporation.

______________ 00

______________ 00

.

.

b

1b

1b

Total percentage of ownership for resident members.

_______________

_______________

c

1c

1c

Multiply Line 1a by Line 1b.

______________ 00

______________ 00

2 a

2a

2a

Modifi ed base income allocable to Illinois.

______________ 00

______________ 00

.

.

b

2b

2b

Total percentage of ownership for nonresident members.

_______________

_______________

c

2c

2c

Multiply Line 2a by Line 2b.

______________ 00

______________ 00

3

3

3

Add Lines 1c and 2c. This amount is your income.

______________ 00

______________ 00

4

4

4

Income tax before credits. Multiply Line 3 by 3% (.03).

______________ 00

______________ 00

5

5

5

Income tax credits. (Schedule 1299-A, see instructions.)

______________ 00

______________ 00

`` 6

Net income tax. Subtract Line 5 from Line 4.

6

6

If negative, write “0”.

______________ 00

______________ 00

Step 4: Figure your net replacement tax

(Complete only if this return includes any trust members.)

7

7

7

Income included in Line 3 that is subject to replacement tax.

______________ 00

______________ 00

8

8

8

Replacement tax before credits. Multiply Line 7 by 1.5% (.015).

______________ 00

______________ 00

9

9

9

Investment credits. (Form IL-477, see instructions.)

______________ 00

______________ 00

10

Net replacement tax. Subtract Line 9 from Line 8.

10

10

If negative, write “0”.

______________ 00

______________ 00

*932001110*

IL-1023-C-X front (R-12/09)

1

1 2

2