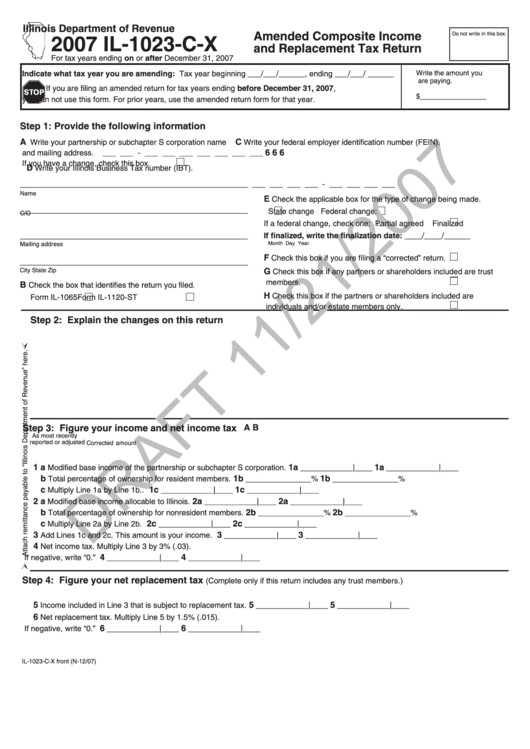

Form Il-1023-C-X Draft - Amended Composite Income And Replacement Tax Return - 2007

ADVERTISEMENT

Illinois Department of Revenue

Amended Composite Income

Do not write in this box.

2007 IL-1023-C-X

and Replacement Tax Return

For tax years ending on or after December 31, 2007

Indicate what tax year you are amending: Tax year beginning ___/___/______, ending ___/___/ ______

Write the amount you

are paying.

If you are filing an amended return for tax years ending before December 31, 2007,

$_________________

you can not use this form. For prior years, use the amended return form for that year.

Step 1: Provide the following information

A

C

Write your partnership or subchapter S corporation name

Write your federal employer identification number (FEIN).

6 6 6

and mailing address.

___ ___ - ___ ___ ___ ___ ___ ___ ___

If you have a change, check this box.

D

Write your Illinois Business Tax number (IBT).

____________________________________________________

___ ___ ___ ___ - ___ ___ ___ ___

Name

E

Check the applicable box for the type of change being made.

____________________________________________________

State change

Federal change:

C/O

If a federal change, check one:

Partial agreed

Finalized

If finalized, write the finalization date: ____/____/______

____________________________________________________

Month

Day

Year

Mailing address

F

Check this box if you are filing a “corrected” return.

____________________________________________________

G

City

State

Zip

Check this box if any partners or shareholders included are trust

members.

B

Check the box that identifies the return you filed.

H

Check this box if the partners or shareholders included are

Form IL-1065

Form IL-1120-ST

individuals and/or estate members only.

Step 2: Explain the changes on this return

Step 3: Figure your income and net income tax

A

B

As most recently

reported or adjusted

Corrected amount

1 a

1a

1a

Modified base income of the partnership or subchapter S corporation.

____________|____

____________|____

b

1b

1b

Total percentage of ownership for resident members.

_______________%

_______________%

c

1c

1c

Multiply Line 1a by Line 1b..

____________|____

____________|____

2 a

2a

2a

Modified base income allocable to Illinois.

____________|____

____________|____

b

2b

2b

Total percentage of ownership for nonresident members.

_______________%

_______________%

c

2c

2c

Multiply Line 2a by Line 2b.

____________|____

____________|____

3

3

3

Add Lines 1c and 2c. This amount is your income.

____________|____

____________|____

4

Net income tax. Multiply Line 3 by 3% (.03).

4

4

If negative, write “0.”

____________|____

____________|____

Step 4: Figure your net replacement tax

(Complete only if this return includes any trust members.)

5

5

5

Income included in Line 3 that is subject to replacement tax.

____________|____

____________|____

6

Net replacement tax. Multiply Line 5 by 1.5% (.015).

6

6

If negative, write “0.”

____________|____

____________|____

IL-1023-C-X front (N-12/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2