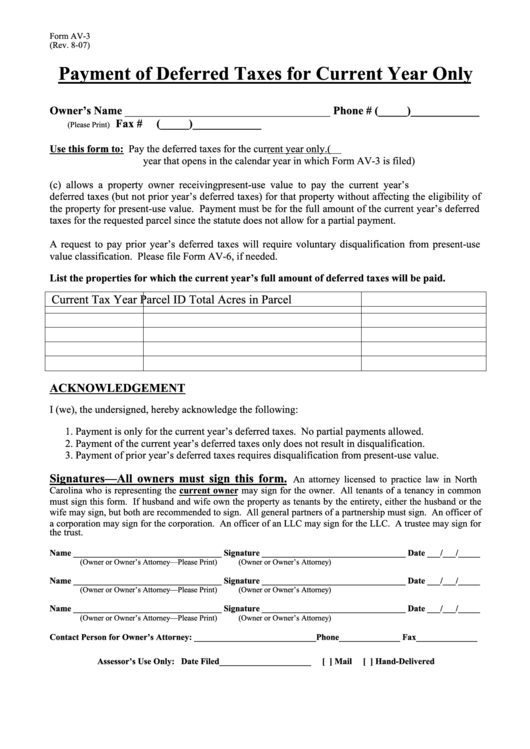

Form Av-3 - Payment Of Deferred Taxes For Current Year Only

ADVERTISEMENT

Form AV-3

(Rev. 8-07)

Payment of Deferred Taxes for Current Year Only

Owner’s Name ____________________________________ Phone # (_____)____________

Fax #

(_____)____________

(Please Print)

Use this form to:

Pay the deferred taxes for the current year only. (i.e. deferred taxes for the fiscal

year that opens in the calendar year in which Form AV-3 is filed)

G.S. 105-277.4(c) allows a property owner receiving present-use value to pay the current year’s

deferred taxes (but not prior year’s deferred taxes) for that property without affecting the eligibility of

the property for present-use value. Payment must be for the full amount of the current year’s deferred

taxes for the requested parcel since the statute does not allow for a partial payment.

A request to pay prior year’s deferred taxes will require voluntary disqualification from present-use

value classification. Please file Form AV-6, if needed.

List the properties for which the current year’s full amount of deferred taxes will be paid.

Current Tax Year

Parcel ID

Total Acres in Parcel

ACKNOWLEDGEMENT

I (we), the undersigned, hereby acknowledge the following:

1. Payment is only for the current year’s deferred taxes. No partial payments allowed.

2. Payment of the current year’s deferred taxes only does not result in disqualification.

3. Payment of prior year’s deferred taxes requires disqualification from present-use value.

Signatures—All owners must sign this form.

An attorney licensed to practice law in North

Carolina who is representing the current owner may sign for the owner. All tenants of a tenancy in common

must sign this form. If husband and wife own the property as tenants by the entirety, either the husband or the

wife may sign, but both are recommended to sign. All general partners of a partnership must sign. An officer of

a corporation may sign for the corporation. An officer of an LLC may sign for the LLC. A trustee may sign for

the trust.

Name __

________________________________ Signature _________________________________ Date ___/___/_____

(Owner or Owner’s Attorney—Please Print)

(Owner or Owner’s Attorney)

Name __

________________________________ Signature _________________________________ Date ___/___/_____

(Owner or Owner’s Attorney—Please Print)

(Owner or Owner’s Attorney)

Name __

________________________________ Signature _________________________________ Date ___/___/_____

(Owner or Owner’s Attorney—Please Print)

(Owner or Owner’s Attorney)

Contact Person for Owner’s Attorney: ____________________________Phone______________ Fax______________

Assessor’s Use Only: Date Filed_____________________

[ ] Mail

[ ] Hand-Delivered

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1