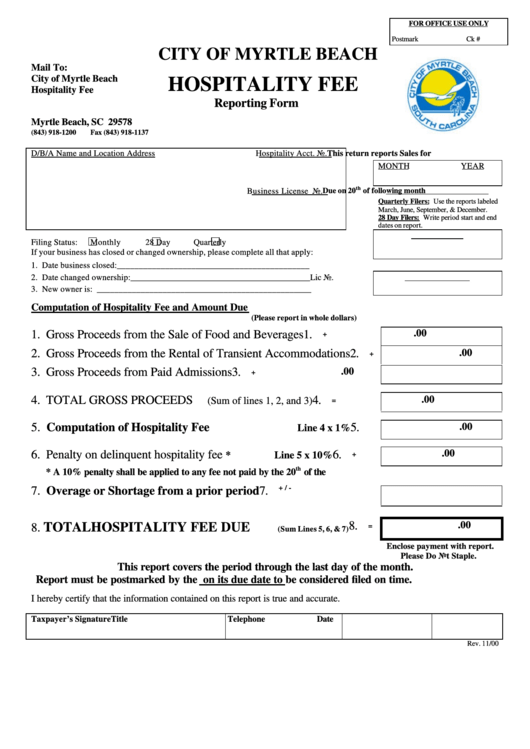

Hospitality Fee Reporting Form - City Of Myrtle Beach, South Carolina

ADVERTISEMENT

FOR OFFICE USE ONLY

Postmark

Ck #

CITY OF MYRTLE BEACH

Mail To:

City of Myrtle Beach

HOSPITALITY FEE

Hospitality Fee

P.O. Box 2468

Reporting Form

Myrtle Beach, SC 29578

(843) 918-1200

Fax (843) 918-1137

D/B/A Name and Location Address

Hospitality Acct. No.

This return reports Sales for

MONTH

YEAR

th

Due on 20

of following month

Business License No.

Quarterly Filers: Use the reports labeled

March, June, September, & December.

28 Day Filers : Write period start and end

dates on report.

F.E.I or SS No.

Filing Status:

Monthly

28 Day

Quarterly

If your business has closed or changed ownership, please complete all that apply:

1. Date business closed:____________________________________________

2. Date changed ownership:_________________________________________

S.C. Retail Lic No.

3. New owner is: _________________________________________________

Computation of Hospitality Fee and Amount Due

(Please report in whole dollars)

.00

1. Gross Proceeds from the Sale of Food and Beverages

1.

+

2. Gross Proceeds from the Rental of Transient Accommodations

2.

.00

+

3. Gross Proceeds from Paid Admissions

3.

.00

+

4. TOTAL GROSS PROCEEDS

4.

.00

(Sum of lines 1, 2, and 3)

=

5. Computation of Hospitality Fee

5.

.00

Line 4 x 1%

.00

6. Penalty on delinquent hospitality fee

6.

*

Line 5 x 10%

+

th

* A 10% penalty shall be applied to any fee not paid by the 20

of the

month.

+ / -

7. Overage or Shortage from a prior period

7.

8.

.00

TOTAL HOSPITALITY FEE DUE

8.

=

(Sum Lines 5, 6, & 7)

Enclose payment with report.

Please Do Not Staple.

This report covers the period through the last day of the month.

Report must be postmarked by the U.S. Postal Service on its due date to be considered filed on time.

I hereby certify that the information contained on this report is true and accurate.

Taxpayer’s Signature

Title

Telephone

Date

Rev. 11/00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1