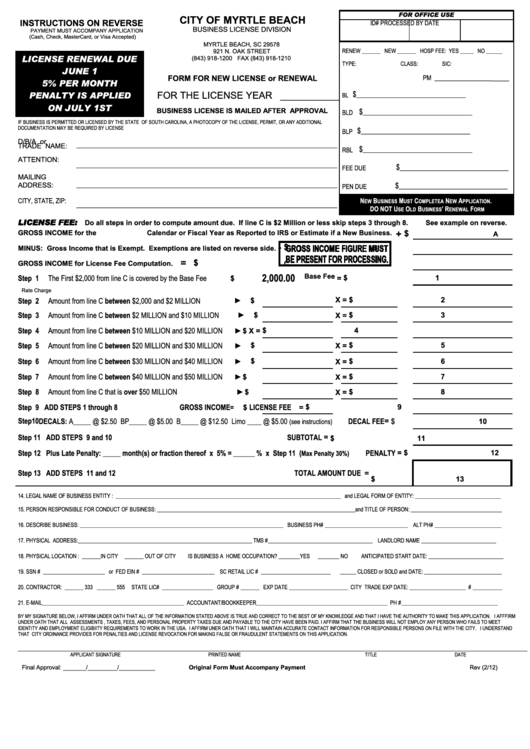

Form For New License Or Renewal - City Of Myrtle Beach

ADVERTISEMENT

FOR OFFICE USE

CITY OF MYRTLE BEACH

INSTRUCTIONS ON REVERSE

ID#

PROCESSED BY

DATE

BUSINESS LICENSE DIVISION

PAYMENT MUST ACCOMPANY APPLICATION

(Cash, Check, MasterCard, or Visa Accepted)

P.O. BOX 2468

MYRTLE BEACH, SC 29578

RENEW _______ NEW _______ HOSP FEE: YES _____ NO ______

921 N. OAK STREET

LICENSE RENEWAL DUE

(843) 918-1200 FAX (843) 918-1210

TYPE:

CLASS:

SIC:

JUNE 1

_____

FORM FOR NEW LICENSE or RENEWAL

PM __________________

5% PER MONTH

PENALTY IS APPLIED

FOR THE LICENSE YEAR ___________

$_______________________________

BL

ON JULY 1ST

BUSINESS LICENSE IS MAILED AFTER APPROVAL

$_______________________________

BLD

IF BUSINESS IS PERMITTED OR LICENSED BY THE STATE OF SOUTH CAROLINA, A PHOTOCOPY OF THE LICENSE, PERMIT, OR ANY ADDITIONAL

DOCUMENTATION MAY BE REQUIRED BY LICENSE INSPECTOR. ALL APPLICABLE SPACES MUST BE COMPLETE BEFORE THE LICENSE WILL BE ISSUED.

$_______________________________

BLP

D/B/A or

___________________________________________________________

$_______________________________

TRADE NAME:

RBL

ATTENTION:

___________________________________________________________

$_______________________________

FEE DUE

MAILING

___________________________________________________________

ADDRESS:

$_______________________________

PEN DUE

CITY, STATE, ZIP:

N

B

M

C

N

A

.

___________________________________________________________

EW

USINESS

UST

OMPLETE A

EW

PPLICATION

DO NOT U

O

B

’ R

F

SE

LD

USINESS

ENEWAL

ORM

LICENSE FEE:

Do all steps in order to compute amount due. If line C is $2 Million or less skip steps 3 through 8.

See example on reverse.

$

GROSS INCOME for the

Calendar or Fiscal Year as Reported to IRS or Estimate if a New Business.

+

A

-

$

B

MINUS: Gross Income that is Exempt. Exemptions are listed on reverse side.

=

$

GROSS INCOME for License Fee Computation.

C

2,000.00

Base Fee

Step 1

The First $2,000 from line C is covered by the Base Fee

$

1

$

=

Rate Charge

Step 2

Amount from line C between $2,000 and $2 MILLION

►

$

X

=

$

2

Step 3

Amount from line C between $2 MILLION and $10 MILLION

$

3

►

$

X

=

Step 4

Amount from line C between $10 MILLION and $20 MILLION

$

4

►

$

X

=

Step 5

Amount from line C between $20 MILLION and $30 MILLION

$

X

=

$

5

►

Step 6

Amount from line C between $30 MILLION and $40 MILLION

$

X

=

$

6

►

Step 7

Amount from line C between $40 MILLION and $50 MILLION

$

7

►

$

X

=

Step 8

Amount from line C that is over $50 MILLION

$

8

►

$

X

=

Step 9

ADD STEPS 1 through 8

GROSS INCOME

LICENSE FEE

$

9

=

$

=

Step 10 DECALS: A_____ @ $2.50 BP_____ @ $5.00 B_____ @ $12.50 Limo ____ @ $5.00

DECAL FEE

=

$

10

(see instructions)

Step 11 ADD STEPS 9 and 10

SUBTOTAL

=

$

11

Step 12 Plus Late Penalty: _____ month(s) or fraction thereof x 5% = ______ % x Step 11 (

PENALTY

Max Penalty 30%)

=

$

12

Step 13 ADD STEPS 11 and 12

TOTAL AMOUNT DUE

=

$

13

14. LEGAL NAME OF BUSINESS ENTITY : ____________________________________________________________________________________ and LEGAL FORM OF ENTITY: ________________________________

15. PERSON RESPONSIBLE FOR CONDUCT OF BUSINESS: __________________________________________________________________________and TITLE OF PERSON: __________________________________

16. DESCRIBE BUSINESS: ____________________________________________________________________________ BUSINESS PH# _______________________________ ALT PH# _________________________

17. PHYSICAL ADDRESS:_________________________________________________________________

TMS #_______________________________________ LANDLORD NAME ____________________________

18. PHYSICAL LOCATION : _______IN CITY

_______ OUT OF CITY

IS BUSINESS A HOME OCCUPATION? ________YES

________ NO

ANTICIPATED START DATE: ____________________________

19. SSN # _______________________ or FED EIN # ___________________________ SC RETAIL LIC # __________________________

______ CLOSED or SOLD and DATE: _____________________________

20. CONTRACTOR: _______ 333 _______ 555

STATE LIC# ___________________ GROUP # _______ EXP DATE ______________________ CITY TRADE EXP DATE: _____________________ # ___________

21. E-MAIL_____________________________________________________ ACCOUNTANT/BOOKKEEPER_________________________________________________ PH #____________________________________

BY MY SIGNATURE BELOW, I AFFIRM UNDER OATH THAT ALL OF THE INFORMATION STATED ABOVE IS TRUE AND CORRECT TO THE BEST OF MY KNOWLEDGE AND THAT I HAVE THE AUTHORITY TO MAKE THIS APPLICATION. I AFFFIRM

UNDER OATH THAT ALL ASSESSMENTS , TAXES, FEES, AND PERSONAL PROPERTY TAXES DUE AND PAYABLE TO THE CITY HAVE BEEN PAID. I AFFIRM THAT THE BUSINESS WILL NOT EMPLOY ANY PERSON WHO FAILS TO MEET

IDENTITY AND EMPLOYMENT ELIGIBIITY REQUIREMENTS TO WORK IN THE USA. I AFFIRM UNER OATH THAT I WILL MAINTAIN ACCURATE CONTACT INFORMATION FOR RESPONSIBLE PERSONS ON FILE WITH THE CITY. I UNDERSTAND

THAT CITY ORDINANCE PROVIDES FOR PENALTIES AND LICENSE REVOCATION FOR MAKING FALSE OR FRAUDULENT STATEMENTS ON THIS APPLICATION.

_____________________________________________________________________________________________________________________________ ___________________________________________________________________________________

APPLICANT SIGNATURE

PRINTED NAME

TITLE

DATE

Final Approval: _______/_________/___________

Original Form Must Accompany Payment

Rev (2/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2