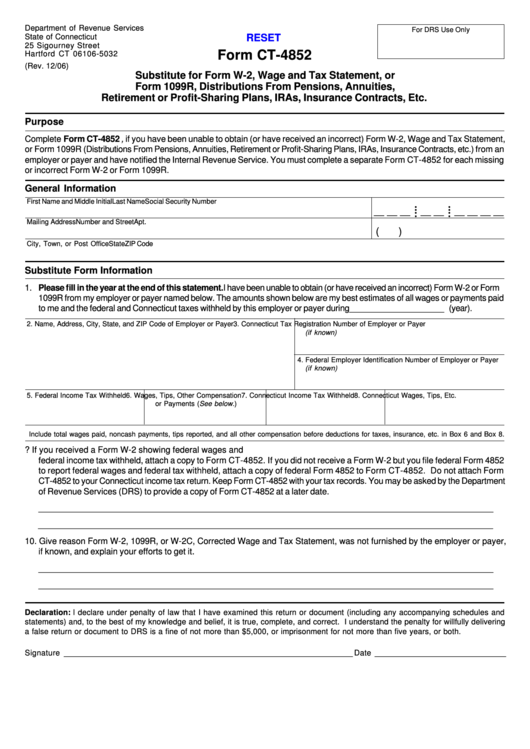

Department of Revenue Services

For DRS Use Only

State of Connecticut

RESET

25 Sigourney Street

Form CT-4852

Hartford CT 06106-5032

(Rev. 12/06)

Substitute for Form W-2, Wage and Tax Statement, or

Form 1099R, Distributions From Pensions, Annuities,

Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, Etc.

Purpose

Complete Form CT-4852, if you have been unable to obtain (or have received an incorrect) Form W-2, Wage and Tax Statement,

or Form 1099R (Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.) from an

employer or payer and have notified the Internal Revenue Service. You must complete a separate Form CT-4852 for each missing

or incorrect Form W-2 or Form 1099R.

General Information

First Name and Middle Initial

Last Name

Social Security Number

• •

• •

__ __ __ __ __ __ __ __ __

• •

• •

Mailing Address

Number and Street

Apt. No.

Telephone Number

(

)

City, Town, or Post Office

State

ZIP Code

Substitute Form Information

1. Please fill in the year at the end of this statement. I have been unable to obtain (or have received an incorrect) Form W-2 or Form

1099R from my employer or payer named below. The amounts shown below are my best estimates of all wages or payments paid

to me and the federal and Connecticut taxes withheld by this employer or payer during ____________________ (year).

2. Name, Address, City, State, and ZIP Code of Employer or Payer

3. Connecticut Tax Registration Number of Employer or Payer

(if known)

4. Federal Employer Identification Number of Employer or Payer

(if known)

5. Federal Income Tax Withheld

6. Wages, Tips, Other Compensation

7. Connecticut Income Tax Withheld

8. Connecticut Wages, Tips, Etc.

or Payments (See below.)

Include total wages paid, noncash payments, tips reported, and all other compensation before deductions for taxes, insurance, etc. in Box 6 and Box 8.

9. How did you determine the amounts in Boxes 5 through 8 above? If you received a Form W-2 showing federal wages and

federal income tax withheld, attach a copy to Form CT-4852. If you did not receive a Form W-2 but you file federal Form 4852

to report federal wages and federal tax withheld, attach a copy of federal Form 4852 to Form CT-4852. Do not attach Form

CT-4852 to your Connecticut income tax return. Keep Form CT-4852 with your tax records. You may be asked by the Department

of Revenue Services (DRS) to provide a copy of Form CT-4852 at a later date.

________________________________________________________________________________________________

________________________________________________________________________________________________

10. Give reason Form W-2, 1099R, or W-2C, Corrected Wage and Tax Statement, was not furnished by the employer or payer,

if known, and explain your efforts to get it.

________________________________________________________________________________________________

________________________________________________________________________________________________

Declaration: I declare under penalty of law that I have examined this return or document (including any accompanying schedules and

statements) and, to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering

a false return or document to DRS is a fine of not more than $5,000, or imprisonment for not more than five years, or both.

Signature __________________________________________________________________ Date ______________________________

1

1