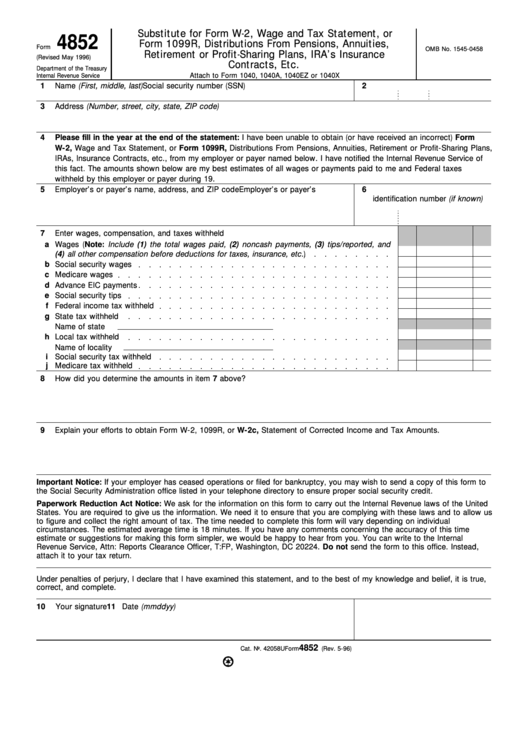

Substitute for Form W-2, Wage and Tax Statement, or

4852

Form 1099R, Distributions From Pensions, Annuities,

Form

OMB No. 1545-0458

Retirement or Profit-Sharing Plans, IRA’s Insurance

(Revised May 1996)

Contracts, Etc.

Department of the Treasury

Attach to Form 1040, 1040A, 1040EZ or 1040X

Internal Revenue Service

1

Name (First, middle, last)

2

Social security number (SSN)

3

Address (Number, street, city, state, ZIP code)

4

Please fill in the year at the end of the statement: I have been unable to obtain (or have received an incorrect) Form

W-2, Wage and Tax Statement, or Form 1099R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans,

IRAs, Insurance Contracts, etc., from my employer or payer named below. I have notified the Internal Revenue Service of

this fact. The amounts shown below are my best estimates of all wages or payments paid to me and Federal taxes

withheld by this employer or payer during 19

.

5

Employer’s or payer’s name, address, and ZIP code

6

Employer’s or payer’s

identification number (if known)

7

Enter wages, compensation, and taxes withheld

a

Wages (Note: Include (1) the total wages paid, (2) noncash payments, (3) tips/reported, and

(4) all other compensation before deductions for taxes, insurance, etc.)

b

Social security wages

c

Medicare wages

d

Advance EIC payments

e

Social security tips

f

Federal income tax withheld

g

State tax withheld

Name of state

h

Local tax withheld

Name of locality

i

Social security tax withheld

j

Medicare tax withheld

8

How did you determine the amounts in item 7 above?

9

Explain your efforts to obtain Form W-2, 1099R, or W-2c, Statement of Corrected Income and Tax Amounts.

Important Notice: If your employer has ceased operations or filed for bankruptcy, you may wish to send a copy of this form to

the Social Security Administration office listed in your telephone directory to ensure proper social security credit.

Paperwork Reduction Act Notice: We ask for the information on this form to carry out the Internal Revenue laws of the United

States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us

to figure and collect the right amount of tax. The time needed to complete this form will vary depending on individual

circumstances. The estimated average time is 18 minutes. If you have any comments concerning the accuracy of this time

estimate or suggestions for making this form simpler, we would be happy to hear from you. You can write to the Internal

Revenue Service, Attn: Reports Clearance Officer, T:FP, Washington, DC 20224. Do not send the form to this office. Instead,

attach it to your tax return.

Under penalties of perjury, I declare that I have examined this statement, and to the best of my knowledge and belief, it is true,

correct, and complete.

10

Your signature

11 Date (mmddyy)

4852

Cat. No. 42058U

Form

(Rev. 5-96)

1

1