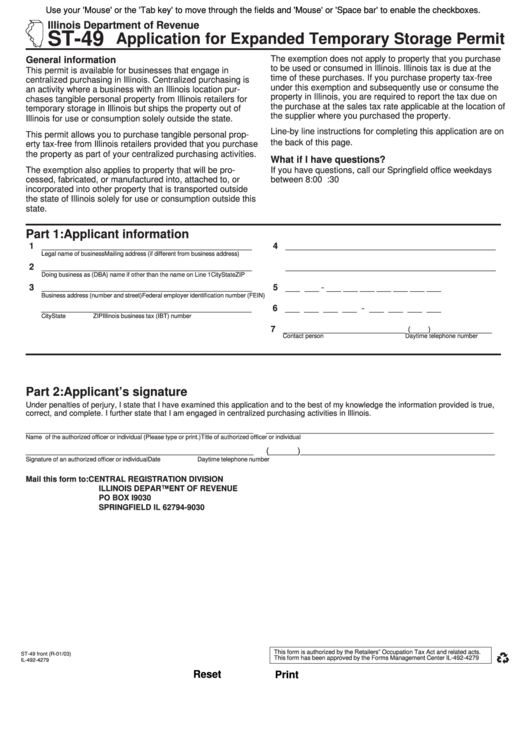

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

ST-49

Application for Expanded Temporary Storage Permit

The exemption does not apply to property that you purchase

General information

to be used or consumed in Illinois. Illinois tax is due at the

This permit is available for businesses that engage in

time of these purchases. If you purchase property tax-free

centralized purchasing in Illinois. Centralized purchasing is

under this exemption and subsequently use or consume the

an activity where a business with an Illinois location pur-

property in Illinois, you are required to report the tax due on

chases tangible personal property from Illinois retailers for

the purchase at the sales tax rate applicable at the location of

temporary storage in Illinois but ships the property out of

the supplier where you purchased the property.

Illinois for use or consumption solely outside the state.

Line-by line instructions for completing this application are on

This permit allows you to purchase tangible personal prop-

the back of this page.

erty tax-free from Illinois retailers provided that you purchase

the property as part of your centralized purchasing activities.

What if I have questions?

The exemption also applies to property that will be pro-

If you have questions, call our Springfield office weekdays

cessed, fabricated, or manufactured into, attached to, or

between 8:00 a.m. and 4:30 p.m. at 217 785-2825.

incorporated into other property that is transported outside

the state of Illinois solely for use or consumption outside this

state.

Part 1: Applicant information

1

4

________________________________________________

________________________________________________

Legal name of business

Mailing address (if different from business address)

2

________________________________________________

________________________________________________

Doing business as (DBA) name if other than the name on Line 1

City

State

ZIP

3

5 ___ ___ - ___ ___ ___ ___ ___ ___ ___

________________________________________________

Business address (number and street)

Federal employer identification number (FEIN)

6 ___ ___ ___ ___ - ___ ___ ___ ___

________________________________________________

City

State

ZIP

Illinois business tax (IBT) number

7

____________________________ (____)______________

Contact person

Daytime telephone number

Part 2: Applicant’s signature

Under penalties of perjury, I state that I have examined this application and to the best of my knowledge the information provided is true,

correct, and complete. I further state that I am engaged in centralized purchasing activities in Illinois.

________________________________________________

________________________________________________

Name of the authorized officer or individual (Please type or print.)

Title of authorized officer or individual

________________________________________________

(______)_________________________________________

Signature of an authorized officer or individual

Date

Daytime telephone number

Mail this form to:

CENTRAL REGISTRATION DIVISION

ILLINOIS DEPARTMENT OF REVENUE

PO BOX I9030

SPRINGFIELD IL 62794-9030

This form is authorized by the Retailers” Occupation Tax Act and related acts.

ST-49 front (R-01/03)

This form has been approved by the Forms Management Center IL-492-4279

IL-492-4279

Reset

Print

1

1 2

2