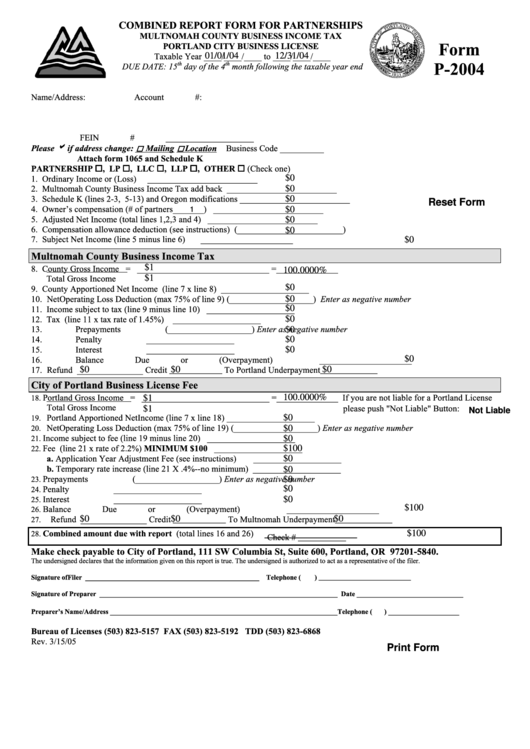

COMBINED REPORT FORM FOR PARTNERSHIPS

MULTNOMAH COUNTY BUSINESS INCOME TAX

Form

PORTLAND CITY BUSINESS LICENSE

Taxable Year ____/____/____ to ____/____/____

01/01/04

12/31/04

P-2004

th

th

DUE DATE: 15

day of the 4

month following the taxable year end

Name/Address:

Account #:

FEIN # ____________________

b

Please

if address change:

Mailing

Location

Business Code __________

Attach form 1065 and Schedule K

PARTNERSHIP

, LP

, LLC

, LLP

, OTHER

(Check one)

1. Ordinary Income or (Loss)

_________________________

$0

2. Multnomah County Business Income Tax add back

_________________________

$0

3. Schedule K (lines 2-3, 5-13) and Oregon modifications

_________________________

$0

Reset Form

4. Owner’s compensation (# of partners_______)

_________________________

$0

1

5. Adjusted Net Income (total lines 1,2,3 and 4)

_________________________

$0

6. Compensation allowance deduction (see instructions)

(________________________)

$0

7. Subject Net Income (line 5 minus line 6)

_____________________

$0

Multnomah County Business Income Tax

8. County Gross Income = ______________________________ =______________

$1

100.0000%

Total Gross Income

$1

9. County Apportioned Net Income (line 7 x line 8)

____________________

$0

10. Net Operating Loss Deduction (max 75% of line 9)

(___________________) Enter as negative number

$0

11. Income subject to tax (line 9 minus line 10)

____________________

$0

12. Tax (line 11 x tax rate of 1.45%)

____________________

$0

13. Prepayments

(___________________) Enter as negative number

$0

14. Penalty

____________________

$0

15. Interest

____________________

$0

16. Balance Due or (Overpayment)

_____________________

$0

17. Refund _______________ Credit ____________ To Portland Underpayment_____________

$0

$0

$0

City of Portland Business License Fee

Portland Gross Income = _____________________________ =______________ If you are not liable for a Portland License

18.

100.0000%

$1

Total Gross Income

please push "Not Liable" Button:

$1

Not Liable

Portland Apportioned Net Income (line 7 x line 18)

____________________

19.

$0

Net Operating Loss Deduction (max 75% of line 19)

(___________________) Enter as negative number

20.

$0

Income subject to fee (line 19 minus line 20)

____________________

21.

$0

Fee (line 21 x rate of 2.2%) MINIMUM $100

____________________

22.

$100

a. Application Year Adjustment Fee (see instructions)

____________________

$0

b. Temporary rate increase (line 21 X .4%--no minimum)

____________________

$0

Prepayments

(___________________) Enter as negative number

23.

$0

Penalty

____________________

24.

$0

Interest

____________________

25.

$0

$100

Balance Due or (Overpayment)

_____________________

26.

Refund _______________ Credit ____________ To Multnomah Underpayment_____________

$0

27.

$0

$0

Combined amount due with report (total lines 16 and 26)

_____________________

$100

28.

Check # ___________

Make check payable to City of Portland, 111 SW Columbia St, Suite 600, Portland, OR 97201-5840.

The undersigned declares that the information given on this report is true. The undersigned is authorized to act as a representative of the filer.

Signature of Filer _________________________________________________ Telephone (

) __________________________

Signature of Preparer ___________________________________________________________________ Date ______________________________

Preparer’s Name/Address ________________________________________________________________ Telephone (

) ____________________

Bureau of Licenses (503) 823-5157

FAX (503) 823-5192

TDD (503) 823-6868

Rev. 3/15/05

Print Form

1

1