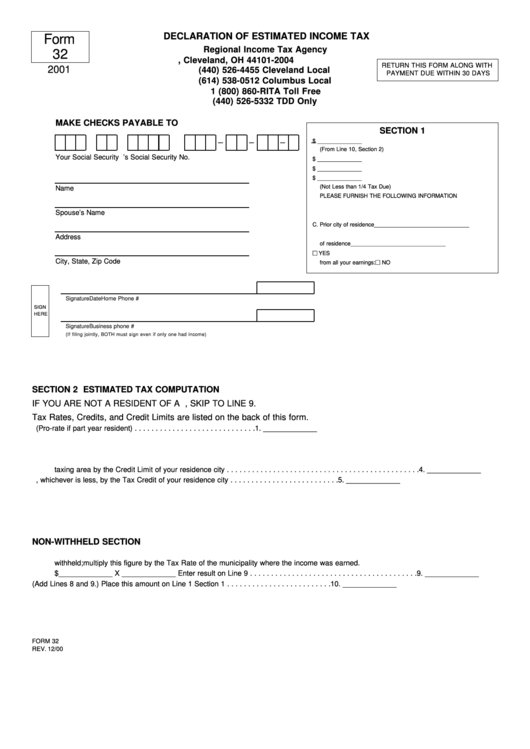

Form 32 - Declaration Of Estimated Income Tax

ADVERTISEMENT

DECLARATION OF ESTIMATED INCOME TAX

Form

Regional Income Tax Agency

32

P.O. Box 6600, Cleveland, OH 44101-2004

RETURN THIS FORM ALONG WITH

2001

(440) 526-4455 Cleveland Local

PAYMENT DUE WITHIN 30 DAYS

(614) 538-0512 Columbus Local

1 (800) 860-RITA Toll Free

(440) 526-5332 TDD Only

MAKE CHECKS PAYABLE TO R.I.T.A.

SECTION 1

1. Total Estimated Tax for 2001 . . . . . . . . . . . . . . . $ ______________

–

–

–

–

(From Line 10, Section 2)

Your Social Security No.

Spouse’s Social Security No.

2. Less Prior Year Credit . . . . . . . . . . . . . . . . . . . . $ ______________

3. Total Tax Due . . . . . . . . . . . . . . . . . . . . . . . . . . $ ______________

4. Amount Paid . . . . . . . . . . . . . . . . . . . . . . . . . . $ ______________

(Not Less than 1/4 Tax Due)

Name

PLEASE FURNISH THE FOLLOWING INFORMATION

A. Municipality where you live

______________________________

Spouse’s Name

B. Municipality where you earn income __________________________

C. Prior city of residence

______________________________

D. Date moved into current city

Address

of residence

______________________________

E. Is municipal tax withheld

YES

City, State, Zip Code

from all your earnings:

NO

Signature

Date

Home Phone #

SIGN

HERE

Signature

Business phone #

(If filing jointly, BOTH must sign even if only one had income)

SECTION 2 ESTIMATED TAX COMPUTATION

IF YOU ARE NOT A RESIDENT OF A R.I.T.A. MUNICIPALITY, SKIP TO LINE 9.

Tax Rates, Credits, and Credit Limits are listed on the back of this form.

1.

Estimate your total taxable income for 2001 (Pro-rate if part year resident) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1. _____________

2.

Multiply Line 1 by Residence City Tax Rate and enter result on Line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. _____________

3.

Tax expected to be withheld or paid to other than your residence municipality . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. _____________

4.

Multiply each separate income earned outside your residence city in another

taxing area by the Credit Limit of your residence city . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. _____________

5.

Multiply Line 3 or 4, whichever is less, by the Tax Credit of your residence city . . . . . . . . . . . . . . . . . . . . . . . . . .

5. _____________

6.

Tax expected to be withheld for residence municipality . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. _____________

7.

Add Lines 5 and 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. _____________

8.

Subtract Line 7 from Line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. _____________

NON-WITHHELD SECTION

9.

Enter below income expected to be earned in a R.I.T.A. municipality not your residence city and not

withheld; multiply this figure by the Tax Rate of the municipality where the income was earned.

$_____________ X _____________ Enter result on Line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9. _____________

10.

Total estimated tax. (Add Lines 8 and 9.) Place this amount on Line 1 Section 1 . . . . . . . . . . . . . . . . . . . . . . . . . 10. _____________

FORM 32

REV. 12/00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1