Form 500es - Declaration Of Estimated Income Tax For Corporations - 2001

ADVERTISEMENT

FORM 500E (2000)

COMMONWEALTH OF VIRGINIA

2001

FORM 500V (2000)

CORPORATION INCOME TAX

FORM 500ES (2001)

PAYMENT VOUCHERS

GENERAL INFORMATION

Businesses with an average monthly liability exceeding

FORM 500E: When requesting an extension of time to file and

$20,000 are required by law to pay their taxes by Electronic

submitting payment of tentative tax due, complete and mail Form

Funds Transfer (EFT). Corporation taxes are included in this

500E Virginia Corporate Extension Payment Voucher and Tenta-

category. Taxpayers who are identified as mandatory EFT filers

tive Tax Return. An extension of six months (the maximum ex-

will be notified by first class mail to begin making payments by

tension of time allowable) will be granted provided that Form

EFT. Taxpayers who do not have an average monthly liability of

500E AND payment of tax due are received by the due date of

$20,000 may voluntarily choose to pay their corporation tax

the corporate income tax return. The form must be filed to re-

payments by EFT. Payments are made directly to the Tax

ceive an extension even when no payment is due. Do not file an

Department’s bank from your business bank account. EFT not

extension unless you are liable for a corporation return.

only saves you the cost and inconvenience of writing checks,

WHERE TO GET HELP: If you are unable to prepare your own

but also, ensures that your return payment will be made on time

return or need assistance, call or visit the Commissioner of the

without the worry of a check being lost in the mail. For more

Revenue, Director of Finance, or Director of Tax Administration

information, call the Office of Customer Services at (804)

for your city or county, or the Department of Taxation. Requests

367-8037.

for information may also be addressed to: Virginia Department

The enclosed vouchers are to be used for:

of Taxation, P.O. Box 1115, Richmond, VA 23218-1115, or call

(804) 367-8037. DO NOT MAIL YOUR RETURNS TO THIS

(a) application for extension and payment of tentative tax due;

ADDRESS.

(b) paying any tax due when filing your income tax return; and

Obtaining forms on the World Wide Web

(c) filing your estimated tax declarations.

If you have access to the World Wide Web, you can obtain most

FORM 500V: When submitting payment with Form 500, Virginia

Virginia income tax forms by connecting to http://

Corporation Income Tax Return, complete and mail Form 500V,

The Department of Taxation menu offers

Virginia Corporation Income Tax Payment Voucher with your re-

information on software needed to read and print the form files.

turn.

You must print the forms to use them. The forms are not designed

to be completed on-screen.

INSTRUCTIONS FOR 2001

DECLARATION OF ESTIMATED INCOME TAX FOR CORPORATIONS

1. FILING REQUIREMENTS

shall file a declaration of estimated tax on the same basis as a

corporation for each taxable year. A consolidated or combined

Every corporation subject to state income taxation must make

return shall be considered the return of a single taxpayer for the

a declaration of estimated income tax for the taxable year if the

purpose of Sections 58.1-500 through 58.1-504 of the Code of

corporation’s state income tax for the same period, reduced by

Virginia.

the allowable tax credits, can be expected to exceed $1,000.

6. FAILURE TO PAY

2. WHERE TO FILE AND PAY

Underpayment of estimated income tax payments will result in

The declaration must be filed with the Virginia Department of

an addition to the tax from the due date of the installment until

Taxation, P.O. Box 1500, Richmond, VA 23218-1500. The declara-

paid, or until the due date for filing the return, whichever is earlier.

tion must be accompanied by a check or money order, made pay-

If the corporation has an underpayment of estimated tax and be-

able to the Virginia Department of Taxation, for the amount of the

lieves an addition to the tax should not be assessed, Form 500C,

installment due.

Corporation Underpayment of Estimated Tax, must be attached

3. WHEN TO FILE AND PAY

to the corporation’s income tax return along with supporting sched-

Taxpayers filing on a fiscal year or calendar year basis should

ules which support the applicable exception (included in Section

follow the declaration and payment schedule in the table shown

58.1-504 (D) of the Code of Virginia ).

below.

7. NO REMINDER NOTICES

4. SHORT TAXABLE YEAR

Reminder notices for estimated tax installments will not be sent

A declaration of estimated income tax is not required for a pe-

to you. Please use the attached vouchers to forward your pay-

riod of less than twelve months, if:

ments when due.

(a)

the period is less than four months; or

8. EXTENSION REQUEST

(b)

the filing requirements are first met after the first day of

the last month in the short taxable year.

To receive an automatic extension of six months or until 30

days after the extended due date for the federal return, which-

Compute taxable income for the short taxable period on an

ever is later, enter your net tentative tax payment on Form 500E.

annual basis by multiplying the income amount by twelve and

The net tentative tax payment is the total estimated income tax

dividing the result by the number of months in the short period.

for the taxable year reduced by estimated tax payments and

Refer to the table shown below to determine the date the decla-

allowable credits. Mail Form 500E and payment to the depart-

ration is to be filed and the number and the dollar amount of

ment by the due date of your corporate income tax return. The

installments to be paid. You are not required to annualize your

form must be filed to receive an extension even when no pay-

income if the short taxable year does not change your account-

ment is due. Electronic Funds Transfer (EFT) filers may either

ing period.

submit this form or may report a zero EFT coporate extension. If

5. CONSOLIDATED OR COMBINED ESTIMATED TAX

no payment is due when submitting this form, enter a zero in the

An affiliated group filing a consolidated or combined return

net tentative tax payment block on the form.

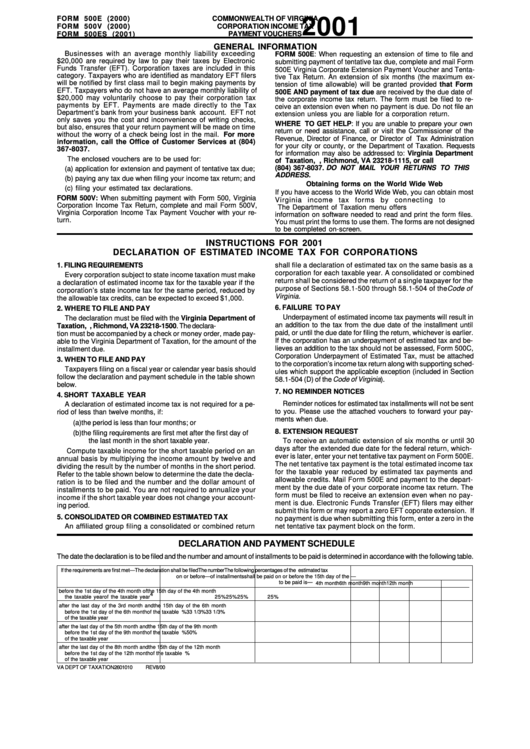

DECLARATION AND PAYMENT SCHEDULE

The date the declaration is to be filed and the number and amount of installments to be paid is determined in accordance with the following table.

If the requirements are first met—

The declaration shall be filed

The number

The following percentages of the estimated tax

on or before—

of installments

shall be paid on or before the 15th day of the —

to be paid is—

4th month 6th month

9th month 12th month

before the 1st day of the 4th month of

the 15th day of the 4th month

4

the taxable year

of the taxable year

25%

25%

25%

25%

after the last day of the 3rd month and

the 15th day of the 6th month

before the 1st day of the 6th month

of the taxable year

3

.......

33 1/3%

33 1/3%

33 1/3%

of the taxable year

after the last day of the 5th month and

the 15th day of the 9th month

before the 1st day of the 9th month

of the taxable year

2

......

.......

50%

50%

of the taxable year

after the last day of the 8th month and

the 15th day of the 12th month

before the 1st day of the 12th month

of the taxable year

1

......

......

......

100%

of the taxable year

VA DEPT OF TAXATION

2601010

REV8/00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4