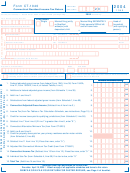

Form Ct-1040 - Connecticut Resident Income Tax Return - 2002 Page 2

ADVERTISEMENT

Schedule 1 Modifications To Federal Adjusted Gross Income ( enter all amounts as positive numbers )

30. Interest on state and local government obligations other than Connecticut

30

31. Mutual fund exempt-interest dividends from non-Connecticut state or municipal government obligations

31

Additions

32. Special depreciation allowance for qualified property

32

to Federal

Adjusted

33. Taxable amount of lump-sum distributions from qualified plans not included in federal adjusted gross income

33

Gross

34. Beneficiary’s share of Connecticut fiduciary adjustment (Enter only if greater than zero)

34

Income (See

instructions,

35. Loss on sale of Connecticut state and local government bonds

35

Page 18)

36. Other - specify __________________________________________________________________________

36

37. TOTAL ADDITIONS (Add Lines 30 through 36) Enter here and on Line 2.

37

38. Interest on U.S. government obligations

38

39. Exempt dividends from certain qualifying mutual funds derived from U.S. government obligations

39

40. Social Security benefit adjustment (See Social Security Benefit Adjustment Worksheet, Page 20)

40

Subtractions

41. Refunds of state and local income taxes

41

from Federal

Adjusted

42. Tier 1 and Tier 2 railroad retirement benefits and supplemental annuities

42

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

Gross

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

43. Do not use. Line reserved for future use

43

Income (See

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

instructions,

44. Beneficiary’s share of Connecticut fiduciary adjustment (Enter only if less than zero)

44

Page 19)

45. Gain on sale of Connecticut state and local government bonds

45

46. Other - specify (Do not include out-of-state income) ___________________________________________

46

47. TOTAL SUBTRACTIONS (Add Lines 38 through 46) Enter here and on Line 4.

47

Schedule 2 Credit for Income Taxes Paid to Qualifying Jurisdictions

48. MODIFIED CONNECTICUT ADJUSTED GROSS INCOME (See instructions, Page 24)

48

Important:

COLUMN A

COLUMN B

You must

FOR EACH COLUMN, ENTER THE FOLLOWING:

Name

Code

Name

Code

attach a

49. Enter qualifying jurisdiction’s name and two-letter code (See instructions, Page 24) 49

copy of your

return filed

50. Non-Connecticut income included on Line 48 and reported on a qualifying

with the

jurisdiction’s income tax return (Complete Schedule 2 Worksheet, Page 23 )

50

.

.

qualifying

51. Divide Line 50 by Line 48 (May not exceed 1.0000)

51

.

jurisdiction(s)

or your

52. Income tax liability (Subtract Line 11 from Line 6 )

52

credit

53. Multiply Line 51 by Line 52

53

will be

disallowed.

54. Income tax paid to a qualifying jurisdiction (See instructions, Page 25)

54

55. Enter the lesser of Line 53 or Line 54

55

56. TOTAL CREDIT (Add Line 55, all columns) Enter here and on Line 7.

56

Schedule 3

Credit for Property Taxes Paid on Your Primary Residence and/or Motor Vehicle

COLUMN A

COLUMN B

COLUMN C

COLUMN D

COLUMN E

QUALIFYING

Name of

List or Bill

Date(s) Paid

Description of Property

(See instructions,

Amount Paid

PROPERTY

Connecticut Tax

If primary residence, enter street address

N u m b e r

Page 26)

If motor vehicle, enter year, make, and model

Town or District

(If available)

PRIMARY

57

RESIDENCE

AUTO 1

58

MARRIED FILING

59

JOINTLY ONLY - AUTO 2

60. TOTAL PROPERTY TAX PAID (Add all amounts for Column E)

60

Property

500 00

61. MAXIMUM PROPERTY TAX CREDIT ALLOWED

61

Tax

62. Enter the Lesser of Line 60 or Line 61. (If $100 or less, enter amount on Line 64. If greater than $100, go to Line 63.)

62

Credit

Calculation

63. Limitation - Enter the result from the Property Tax Credit Limitation Worksheet (See Page 27)

63

64. Subtract Line 63 from Line 62. Enter here and on Line 11.

64

Schedule 4 Contributions of Refund to Designated Charities (See instructions, Page 28)

AIDS Research

___ $2

__ $5

_ $15

other ___ .00

Breast Cancer Research

___ $2

__ $5

_ $15

other ___ .00

Organ Transplant

___ $2

__ $5

_ $15

other ___ .00

Safety Net Services

___ $2

__ $5

_ $15

other ___ .00

Endangered Species/Wildlife

___ $2

__ $5

_ $15

other ___ .00

00

65. TOTAL CONTRIBUTIONS. Enter here and on Line 23.

65

Third

Do you authorize DRS to contact another person about this return? ( See Page 17 )

Yes. Complete the following.

No

Party

Designee’s Name

Telephone Number

Personal Identification

Designee

(

)

Number (PIN)

I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge and belief,

it is true, complete, and correct. I understand that the penalty for willfully delivering a false return to DRS is a fine of not more than $5,000, or imprisonment for not

more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Sign Here

Your Signature

Date

Daytime Telephone Number

(

)

Keep a

Spouse’s Signature (if joint return)

Date

Daytime Telephone Number

copy for

(

)

your

records.

Paid Preparer’s Signature

Date

Telephone Number

Preparer’s SSN or PTIN

(

)

Firm’s Name, Address, and ZIP Code

FEIN

Form CT-1040 Back (Rev. 12/02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2