Form 200 - Virginia Litter Tax Return With Instructions - 1998

ADVERTISEMENT

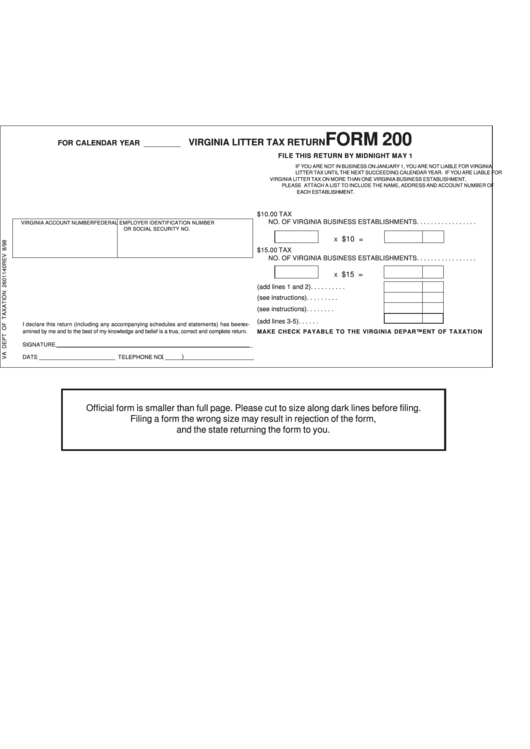

FORM 200

VIRGINIA LITTER TAX RETURN

FOR CALENDAR YEAR

FILE THIS RETURN BY MIDNIGHT MAY 1

IF YOU ARE NOT IN BUSINESS ON JANUARY 1, YOU ARE NOT LIABLE FOR VIRGINIA

LITTER TAX UNTIL THE NEXT SUCCEEDING CALENDAR YEAR. IF YOU ARE LIABLE FOR

VIRGINIA LITTER TAX ON MORE THAN ONE VIRGINIA BUSINESS ESTABLISHMENT,

PLEASE ATTACH A LIST TO INCLUDE THE NAME, ADDRESS AND ACCOUNT NUMBER OF

EACH ESTABLISHMENT.

1. ANNUAL $10.00 TAX

NO. OF VIRGINIA BUSINESS ESTABLISHMENTS . . . . . . . . . . . . . . . . .

VIRGINIA ACCOUNT NUMBER

FEDERAL EMPLOYER IDENTIFICATION NUMBER

OR SOCIAL SECURITY NO.

$10 =

X

2. ADDITIONAL ANNUAL $15.00 TAX

NO. OF VIRGINIA BUSINESS ESTABLISHMENTS . . . . . . . . . . . . . . . . .

$15 =

X

3. TOTAL (add lines 1 and 2) . . . . . . . . . .

4. PENALTY (see instructions) . . . . . . . . .

5. INTEREST (see instructions) . . . . . . . .

6. BALANCE DUE (add lines 3-5) . . . . . .

I declare this return (including any accompanying schedules and statements) has been ex-

amined by me and to the best of my knowledge and belief is a true, correct and complete return.

MAKE CHECK PAYABLE TO THE VIRGINIA DEPARTMENT OF TAXATION

SIGNATURE ______________________________________________________________

(

)

DATE ________________________ TELEPHONE NO. ____________________________

Official form is smaller than full page. Please cut to size along dark lines before filing.

Filing a form the wrong size may result in rejection of the form,

and the state returning the form to you.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2