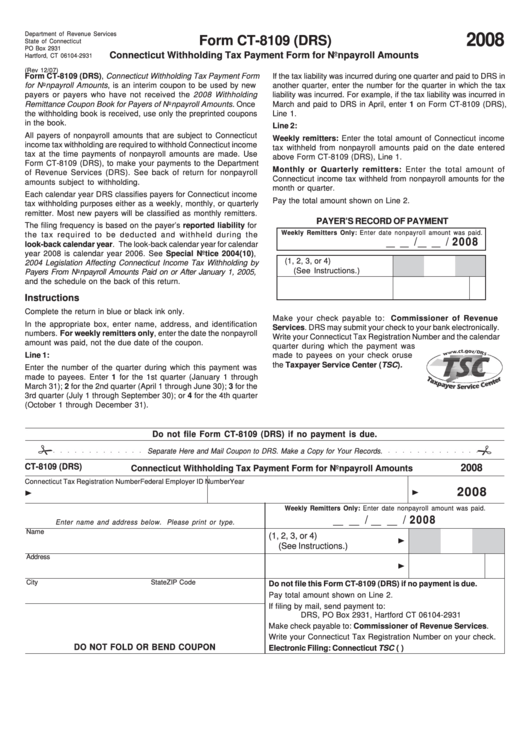

Form Ct-8109 (Drs) - Connecticut Withholding Tax Payment Form For Nonpayroll Amounts

ADVERTISEMENT

Department of Revenue Services

2008

Form CT-8109 (DRS)

State of Connecticut

PO Box 2931

Connecticut Withholding Tax Payment Form for Nonpayroll Amounts

Hartford, CT 06104-2931

(Rev 12/07)

Form CT-8109 (DRS), Connecticut Withholding Tax Payment Form

If the tax liability was incurred during one quarter and paid to DRS in

for Nonpayroll Amounts, is an interim coupon to be used by new

another quarter, enter the number for the quarter in which the tax

payers or payers who have not received the 2008 Withholding

liability was incurred. For example, if the tax liability was incurred in

Remittance Coupon Book for Payers of Nonpayroll Amounts. Once

March and paid to DRS in April, enter 1 on Form CT-8109 (DRS),

the withholding book is received, use only the preprinted coupons

Line 1.

in the book.

Line 2:

All payers of nonpayroll amounts that are subject to Connecticut

Weekly remitters: Enter the total amount of Connecticut income

income tax withholding are required to withhold Connecticut income

tax withheld from nonpayroll amounts paid on the date entered

tax at the time payments of nonpayroll amounts are made. Use

above Form CT-8109 (DRS), Line 1.

Form CT-8109 (DRS), to make your payments to the Department

Monthly or Quarterly remitters: Enter the total amount of

of Revenue Services (DRS). See back of return for nonpayroll

Connecticut income tax withheld from nonpayroll amounts for the

amounts subject to withholding.

month or quarter.

Each calendar year DRS classifies payers for Connecticut income

Pay the total amount shown on Line 2.

tax withholding purposes either as a weekly, monthly, or quarterly

remitter. Most new payers will be classified as monthly remitters.

PAYER’S RECORD OF PAYMENT

The filing frequency is based on the payer’s reported liability for

Weekly Remitters Only: Enter date nonpayroll amount was paid.

the tax required to be deducted and withheld during the

_ _ /_ _ / 200 8

look-back calendar year. The look-back calendar year for calendar

year 2008 is calendar year 2006. See Special Notice 2004(10),

1. Enter quarter (1, 2, 3, or 4)

2004 Legislation Affecting Connecticut Income Tax Withholding by

(See Instructions.)

Payers From Nonpayroll Amounts Paid on or After January 1, 2005,

and the schedule on the back of this return.

2. Connecticut tax withheld

Instructions

Complete the return in blue or black ink only.

Make your check payable to: Commissioner of Revenue

In the appropriate box, enter name, address, and identification

Services. DRS may submit your check to your bank electronically.

numbers. For weekly remitters only, enter the date the nonpayroll

Write your Connecticut Tax Registration Number and the calendar

amount was paid, not the due date of the coupon.

quarter during which the payment was

Line 1:

made to payees on your check or use

the Taxpayer Service Center (TSC).

Enter the number of the quarter during which this payment was

made to payees. Enter 1 for the 1st quarter (January 1 through

March 31); 2 for the 2nd quarter (April 1 through June 30); 3 for the

3rd quarter (July 1 through September 30); or 4 for the 4th quarter

(October 1 through December 31).

Do not file Form CT-8109 (DRS) if no payment is due.

Separate Here and Mail Coupon to DRS. Make a Copy for Your Records.

2008

CT-8109 (DRS)

Connecticut Withholding Tax Payment Form for Nonpayroll Amounts

Connecticut Tax Registration Number

Federal Employer ID Number

Year

2008

Weekly Remitters Only: Enter date nonpayroll amount was paid.

_ _ / _ _ / 200 8

Enter name and address below. Please print or type.

Name

1. Enter quarter (1, 2, 3, or 4)

(See Instructions.)

Address

2. Connecticut tax withheld

City

State

ZIP Code

Do not file this Form CT-8109 (DRS) if no payment is due.

Pay total amount shown on Line 2.

If filing by mail, send payment to:

DRS, PO Box 2931, Hartford CT 06104-2931

Make check payable to: Commissioner of Revenue Services.

Write your Connecticut Tax Registration Number on your check.

DO NOT FOLD OR BEND COUPON

Electronic Filing: Connecticut TSC ( )

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1