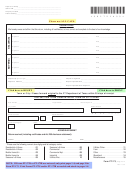

Buyer #1 or Entity ____________________________________________________

*081721200*

SSN or FID __________________________________________________________

Property Location ____________________________________________________

Date of Closing ______________________________________________________

* 0 8 1 7 2 1 2 0 0 *

Please use ALL CAPS.

C.

PROPERTY LOCATION

Number and Street or Road Name

City or Town

VT

D.

E.

DATE OF CLOSING

INTEREST IN PROPERTY - Write the number from the list

If “4”, enter

%

.

% Interest here

1. Fee Simple

3. Undivided 1/2 Interest

7. Easement/Row

5. Time-Share

M M

D

D

Y

Y

Y Y

2. Life Estate

4. Undivided __% Interest

6. Lease

8. Other ___________________________

G.

SPECIAL

F.

LAND SIZE (Acres or fraction thereof)

If sale was between family members,

Check if development rights

FACTORS

enter number from list below

have been conveyed

±

.

1. Husband/Wife 2. Parent/Child 3. Grandparent/Grandchild 4. Other ________________________

FINANCING:

Conventional/Bank

Owner Financing

Other _________________________________

H.

TYPE OF BUILDING CONSTRUCTION AT THE TIME OF TRANSFER (Check all that apply)

1.

None

5.

Farm Buildings

9.

Store

2.

Factory

6.

Multi-Family with

Dwelling Units Transferred

10.

Residential New Construction

3.

Single Family Dwelling

7.

Mobile Home

11.

Other _______________________

4.

Seasonal Dwelling

8.

Condominium with

Units Transferred

I.

SELLER’S USE OF PROPERTY

1. Primary Residence

4. Timberland

7. Commercial _____________________

BEFORE TRANSFER

2. Open Land

5. Operating Farm

8. Industrial _______________________

(Enter number from list)

3. Secondary Residence

6. Government Use

9. Other __________________________

Check if property was rented BEFORE transfer

J.

BUYER’S USE OF PROPERTY

4. Timberland

7. Commercial _____________________

1. Primary Residence

AFTER TRANSFER

2. Open Land

5. Operating Farm

8. Industrial _______________________

(Enter number from list)

6. Government Use

9. Other __________________________

3. Secondary Residence

Check if property will be rented AFTER transfer

Check if property was purchased by tenant

Check if buyer holds title to any adjoining property

K.

L.

AGRICULTURAL/MANAGED FOREST LAND USE VALUE PROGRAM, 32 V.S.A. Chapter 124

If transfer is exempt from Property Transfer

Tax, cite exemption number from instructions and

1. Check if property being conveyed is subject to a land use change tax lien

complete Sections M, N, and O below.

2. Check if new owner elects to continue enrollment of eligible property

M.

TOTAL Price Paid

N.

Price paid for Personal Property

O.

Price paid for Real Property

.

00

.

00

.

00

State type of Personal Property ____________________________________________________________________________________________________________________

If price paid for Real Property is less than fair market value, please explain __________________________________________________________________________________

Value of purchaser’s principal

P.

Q.

Fair market value of property enrolled in current use

R.

Fair market value of qualified working farm

residence included in Line O for

included in Line O for special tax rate

program included in Line O for special tax rate

special tax rate (See instructions)

.

00

.

00

.

00

S.

PROPERTY TRANSFER TAX DUE from rate schedule on page 3 of this form.

COMPLETE RATE SCHEDULE FOR ALL TRANSFERS.

.

Make checks payable to VERMONT DEPARTMENT OF TAXES

T.

DATE SELLER ACQUIRED

U.

IF A VERMONT LAND GAINS TAX RETURN IS NOT BEING FILED, cite exemption(s) from instructions on page 5 of

this booklet

M M

D

D

Y

Y

Y Y

Form PT-172,

Page 2 of 4

Rev. 11/10

1

1 2

2 3

3 4

4