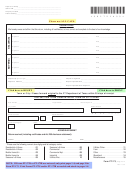

Buyer #1 or Entity ____________________________________________________

*081721300*

SSN or FID __________________________________________________________

Property Location ____________________________________________________

Date of Closing ______________________________________________________

* 0 8 1 7 2 1 3 0 0 *

Please use ALL CAPS.

RATE SCHEDULE

Tax on Special Rate Property

1. Value of purchaser’s principal residence. Also enter on Line P. (See instructions) . . . . . . . . . . . . . . . . . . . . . . . 1. _______________________

2. Value of property enrolled in current use program. Also enter on Line Q. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. _______________________

3. Value of qualified working farm. Also enter on Line R. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. _______________________

4. Add Lines 1, 2, and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. _______________________

0.005

5. Tax rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. _______________________

6. Tax due on Special Rate Property (Multiply Line 4 by Line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. _______________________

Tax on General Rate Property

7. Enter amount from Line O on page 2 of this form . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. _______________________

8. Enter amount from Line 4 above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8. _______________________

9. Subtract Line 8 from Line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9. _______________________

0.0125

10. Tax rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10. _______________________

11. Tax due on General Rate Property (Multiply Line 9 by Line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11. _______________________

TOTAL TAX DUE

0.00

12. Add Line 6 and Line 11. Enter here and on Line S on page 2 of this form. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12. _______________________

LOCAL AND STATE PERMITS AND ACT 250 CERTIFICATES

Buyer(s) and Seller(s) certify as follows:

A. That they have investigated and disclosed to every party to this transaction all of their knowledge relating to flood regulations, if any, affecting the

property.

B. That the seller(s) advised the buyer(s) that local and state building regulations, zoning regulations and subdivision regulations and wastewater

system and potable water supply rules under 10 V.S.A. Chapter 64 pertaining to the property may limit significantly the use of the property.

C. That this transfer is in compliance with or is exempt from the wastewater system and potable water supply rules of the Agency of Natural Resources

for the following reasons:

1.This property is the subject of Permit Number ___________________ and is in compliance with said permit, or

2.This property and any retained parcel is exempt from the wastewater system and potable water supply rules because (see instructions for

exemptions):

a.

Parcel to be sold:

Exemption Number ______________

b.

Parcel retained:

Exemption Number ______________

Seller(s) further certifies as follows:

D. That this transfer of real property and any development thereon is in compliance with or exempt from 10 V.S.A. Chapter 151, Vermont’s Land Use

and Development law (Act 250), for the following reason:

1.

This property is the subject of Act 250 Permit Number_________________ and is in compliance with said permit, or

2.

This property is exempt from Act 250 because (list exemption number from Line D in instructions): ____________________

E. That this transfer does / does not (strike one) result in a partition or subdivision of land. Note: If it does, an Act 250 Disclosure Statement must be

attached to this return before filing with the town clerk (see Line E instructions).

WITHHOLDING CERTIFICATION

Buyer(s) certifies that Vermont income tax has been withheld from the purchase price and will be remitted to the Commissioner of Taxes with Form

RW-171 within 30 days from the transfer,

OR that the transfer is exempt from income tax withholding for the following reason (check one):

1. Under penalties of perjury, seller(s) certifies that at the time of transfer, each seller was a resident of Vermont or an estate.

2. Buyer(s) certifies that the parties obtained withholding certificate number _________________ from the Commissioner of Taxes in advance of

this sale.

3. Buyer(s) certifies that this is a transfer without consideration. (See instructions for Form RW-171.)

4. Seller(s) is a mortgagor conveying the mortgaged property to a mortgagee in a foreclosure or transfer in lieu of foreclosure, with no additional

consideration.

Form PT-172,

Page 3 of 4

Rev. 11/10

1

1 2

2 3

3 4

4