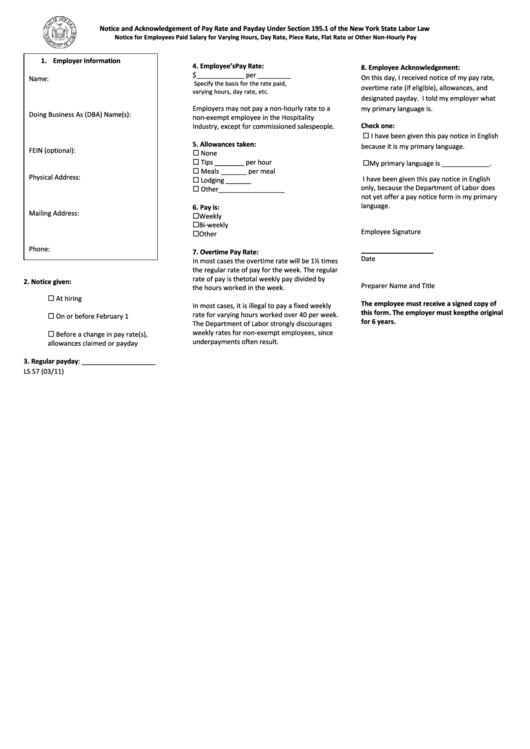

Notice and Acknowledgement of Pay Rate and Payday Under Section 195.1 of the New York State Labor Law

Notice for Employees Paid Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other Non-Hourly Pay

1. Employer Information

4. Employee’s Pay Rate:

8. Employee Acknowledgement:

$_____________ per _________

On this day, I received notice of my pay rate,

Name:

Specify the basis for the rate paid, i.e. salary for

overtime rate (if eligible), allowances, and

varying hours, day rate, etc.

designated payday. I told my employer what

Employers may not pay a non-hourly rate to a

my primary language is.

Doing Business As (DBA) Name(s):

non-exempt employee in the Hospitality

Check one:

Industry, except for commissioned salespeople.

I have been given this pay notice in English

5. Allowances taken:

because it is my primary language.

FEIN (optional):

None

Tips ________ per hour

My primary language is _____________.

Meals _______ per meal

Physical Address:

I have been given this pay notice in English

Lodging _______

only, because the Department of Labor does

Other __________________

not yet offer a pay notice form in my primary

language.

6. Pay is:

Mailing Address:

Weekly

Bi-weekly

Employee Signature

Other

Phone:

7. Overtime Pay Rate:

Date

In most cases the overtime rate will be 1½ times

the regular rate of pay for the week. The regular

rate of pay is the total weekly pay divided by

2. Notice given:

Preparer Name and Title

the hours worked in the week.

At hiring

The employee must receive a signed copy of

In most cases, it is illegal to pay a fixed weekly

this form. The employer must keep the original

rate for varying hours worked over 40 per week.

On or before February 1

for 6 years.

The Department of Labor strongly discourages

weekly rates for non-exempt employees, since

Before a change in pay rate(s),

underpayments often result.

allowances claimed or payday

3. Regular payday: ____________________

LS 57 (03/11)

1

1